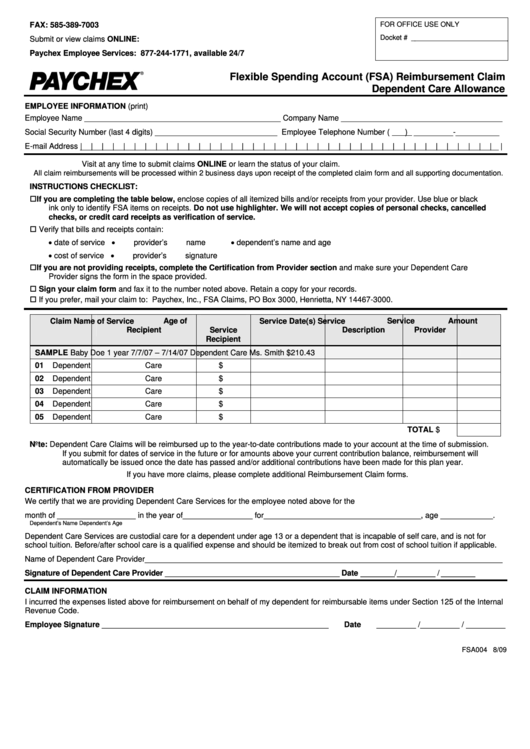

Form Fsa004 - Flexible Spending Account (Fsa) Reimbursement Claim - Dependent Care Allowance (Paychex)

ADVERTISEMENT

FOR OFFICE USE ONLY

FAX: 585-389-7003

Docket # __________________________

Submit or view claims ONLINE:

Paychex Employee Services: 877-244-1771, available 24/7

Flexible Spending Account (FSA) Reimbursement Claim

Dependent Care Allowance

EMPLOYEE INFORMATION (print)

Employee Name _____________________________________________ Company Name _____________________________________

Social Security Number (last 4 digits) ____________________________

Employee Telephone Number (

) _________- __________

E-mail Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Visit at any time to submit claims ONLINE or learn the status of your claim.

All claim reimbursements will be processed within 2 business days upon receipt of the completed claim form and all supporting documentation.

INSTRUCTIONS CHECKLIST:

If you are completing the table below, enclose copies of all itemized bills and/or receipts from your provider. Use blue or black

ink only to identify FSA items on receipts. Do not use highlighter. We will not accept copies of personal checks, cancelled

checks, or credit card receipts as verification of service.

Verify that bills and receipts contain:

•

•

•

date of service

provider’s name

dependent’s name and age

•

•

cost of service

provider’s signature

If you are not providing receipts, complete the Certification from Provider section and make sure your Dependent Care

Provider signs the form in the space provided.

Sign your claim form and fax it to the number noted above. Retain a copy for your records.

If you prefer, mail your claim to: Paychex, Inc., FSA Claims, PO Box 3000, Henrietta, NY 14467-3000.

Claim

Name of Service

Age of

Service Date(s)

Service

Service

Amount

Recipient

Service

Description

Provider

Recipient

SAMPLE

Baby Doe

1 year

7/7/07 – 7/14/07

Dependent Care

Ms. Smith

$210.43

01

Dependent Care

$

02

Dependent Care

$

03

Dependent Care

$

04

Dependent Care

$

05

Dependent Care

$

TOTAL

$

Note:

Dependent Care Claims will be reimbursed up to the year-to-date contributions made to your account at the time of submission.

If you submit for dates of service in the future or for amounts above your current contribution balance, reimbursement will

automatically be issued once the date has passed and/or additional contributions have been made for this plan year.

If you have more claims, please complete additional Reimbursement Claim forms.

CERTIFICATION FROM PROVIDER

We certify that we are providing Dependent Care Services for the employee noted above for the

month of __________________ in the year of________________ for ____________________________________ , age ____________ .

Dependent’s Name

Dependent’s Age

Dependent Care Services are custodial care for a dependent under age 13 or a dependent that is incapable of self care, and is not for

school tuition. Before/after school care is a qualified expense and should be itemized to break out from cost of school tuition if applicable.

Name of Dependent Care Provider __________________________________________________________________________________

Signature of Dependent Care Provider _________________________________________

Date ________ /_________ / ________

CLAIM INFORMATION

I incurred the expenses listed above for reimbursement on behalf of my dependent for reimbursable items under Section 125 of the Internal

Revenue Code.

Employee Signature ____________________________________________________

Date _________ / _________ / _________

FSA004 8/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1