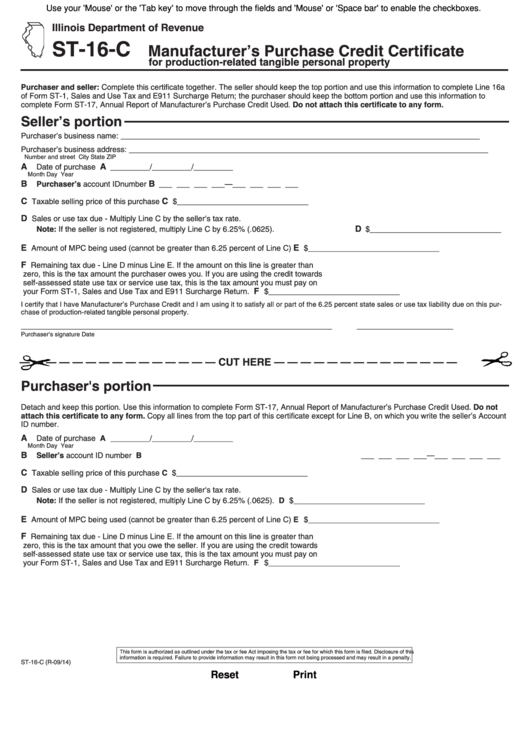

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-16-C

Manufacturer’s Purchase Credit Certificate

for production-related tangible personal property

Purchaser and seller: Complete this certificate together. The seller should keep the top portion and use this information to complete Line 16a

of Form ST-1, Sales and Use Tax and E911 Surcharge Return; the purchaser should keep the bottom portion and use this information to

complete Form ST-17, Annual Report of Manufacturer’s Purchase Credit Used. Do not attach this certificate to any form.

Seller’s portion

Purchaser’s business name:

__________________________________________________________________________________

Purchaser’s business address:

__________________________________________________________________________________

Number and street

City

State

ZIP

A

A

Date of purchase

_________/_________/_________

Month

Day

Year

B

B

Purchaser’s account ID number

___ ___ ___ ___—___ ___ ___ ___

C

C

Taxable selling price of this purchase

$______________________________

D

Sales or use tax due - Multiply Line C by the seller's tax rate.

D

Note: If the seller is not registered, multiply Line C by 6.25% (.0625).

$______________________________

E

E

Amount of MPC being used (cannot be greater than 6.25 percent of Line C)

$______________________________

F

Remaining tax due - Line D minus Line E. If the amount on this line is greater than

zero, this is the tax amount the purchaser owes you. If you are using the credit towards

self-assessed state use tax or service use tax, this is the tax amount you must pay on

F

your Form ST-1, Sales and Use Tax and E911 Surcharge Return.

$______________________________

I certify that I have Manufacturer’s Purchase Credit and I am using it to satisfy all or part of the 6.25 percent state sales or use tax liability due on this pur-

chase of production-related tangible personal property.

_______________________________________________________________________

______________________

Purchaser's signature

Date

— — — — — — — — — — — — — — — CUT HERE — — — — — — — — — — — — — —

Purchaser's portion

Detach and keep this portion. Use this information to complete Form ST-17, Annual Report of Manufacturer’s Purchase Credit Used. Do not

attach this certificate to any form. Copy all lines from the top part of this certificate except for Line B, on which you write the seller’s Account

ID number.

A

Date of purchase

A _________/_________/_________

Month

Day

Year

B

Seller’s account ID number

B ___ ___ ___ ___—___ ___ ___ ___

C

Taxable selling price of this purchase

C $______________________________

D

Sales or use tax due - Multiply Line C by the seller's tax rate.

Note: If the seller is not registered, multiply Line C by 6.25% (.0625).

D $______________________________

E

Amount of MPC being used (cannot be greater than 6.25 percent of Line C)

E $______________________________

F

Remaining tax due - Line D minus Line E. If the amount on this line is greater than

zero, this is the tax amount that you owe the seller. If you are using the credit towards

self-assessed state use tax or service use tax, this is the tax amount you must pay on

F $______________________________

your Form ST-1, Sales and Use Tax and E911 Surcharge Return.

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

ST-16-C (R-09/14)

Reset

Print

1

1