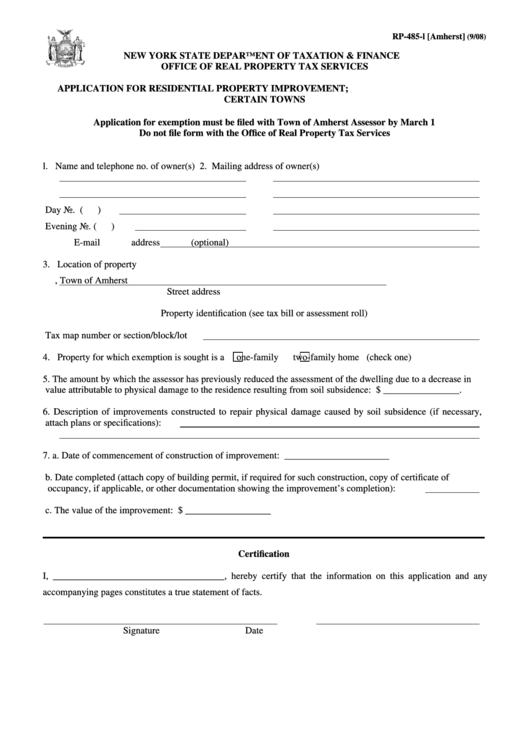

Form Rp-485-L - Application For Residential Property Improvement; Certain Towns 2008

ADVERTISEMENT

RP-485-l [Amherst]

(9/08)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR RESIDENTIAL PROPERTY IMPROVEMENT;

CERTAIN TOWNS

Application for exemption must be filed with Town of Amherst Assessor by March 1

Do not file form with the Office of Real Property Tax Services

l.

Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property

, Town of Amherst

Street address

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

4. Property for which exemption is sought is a

one-family

two-family home (check one)

5. The amount by which the assessor has previously reduced the assessment of the dwelling due to a decrease in

value attributable to physical damage to the residence resulting from soil subsidence: $ ________________.

6. Description of improvements constructed to repair physical damage caused by soil subsidence (if necessary,

attach plans or specifications):

7. a. Date of commencement of construction of improvement: ______________________

b. Date completed (attach copy of building permit, if required for such construction, copy of certificate of

occupancy, if applicable, or other documentation showing the improvement’s completion):

c. The value of the improvement: $ __________________

Certification

I, ____________________________________, hereby certify that the information on this application and any

accompanying pages constitutes a true statement of facts.

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2![Form Rp-485-l [amherst] - Application For Residential Property Improvement; Certain Towns Form Rp-485-l [amherst] - Application For Residential Property Improvement; Certain Towns](https://data.formsbank.com/pdf_docs_html/320/3209/320956/page_1_thumb.png)