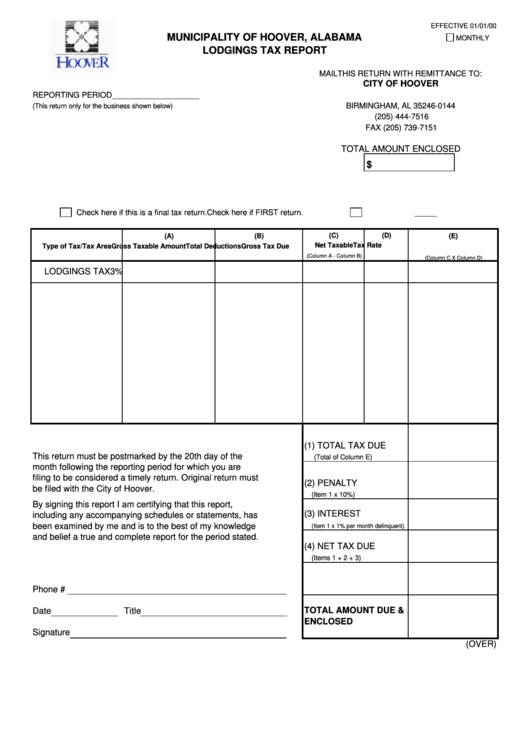

Lodgings Tax Report Form - Municipality Of Hoover, Alabama

ADVERTISEMENT

EFFECTIVE 01/01/00

MUNICIPALITY OF HOOVER, ALABAMA

MONTHLY

LODGINGS TAX REPORT

MAILTHIS RETURN WITH REMITTANCE TO:

CITY OF HOOVER

REPORTING PERIOD____________________

P.O. BOX 11407

BIRMINGHAM, AL 35246-0144

(This return only for the business shown below)

(205) 444-7516

FAX (205) 739-7151

TOTAL AMOUNT ENCLOSED

$

Check here if this is a final tax return.

Check here if FIRST return.

(C)

(D)

(A)

(B)

(E)

Net Taxable

Tax Rate

Type of Tax/Tax Area

Gross Taxable Amount

Total Deductions

Gross Tax Due

(Column A - Column B)

(Column C X Column D)

LODGINGS TAX

3%

(1) TOTAL TAX DUE

This return must be postmarked by the 20th day of the

(Total of Column E)

month following the reporting period for which you are

filing to be considered a timely return. Original return must

(2) PENALTY

be filed with the City of Hoover.

(Item 1 x 10%)

By signing this report I am certifying that this report,

(3) INTEREST

including any accompanying schedules or statements, has

been examined by me and is to the best of my knowledge

(Item 1 x 1% per month delinquent)

and belief a true and complete report for the period stated.

(4) NET TAX DUE

(Items 1 + 2 + 3)

Phone #

TOTAL AMOUNT DUE &

Date

Title

ENCLOSED

Signature

(OVER)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2