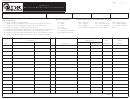

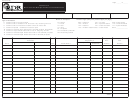

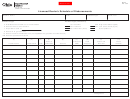

Form Mf-52b - Motor Fuel Tax Multiple Schedule Of Disbursements Special Fuel - 2004 Page 2

ADVERTISEMENT

Instructions for Schedule of Disbursements, Special Fuel (MF-52B)

This schedule(s) provides detail in support of the gallons shown as disbursements on the distributor’s return. Each disbursement of product must be listed on separate

lines of the appropriate schedules.

Schedule Type - Enter the appropriate schedule number, using separate schedules for each type.

Column Instructions

Columns 1 & 2

Carrier - Enter the name and FEIN of the company that transports the products.

Column 3

Mode of Transport - Enter the mode of transport. Use one of the following: J - Truck, PL - Pipeline, B - Barge, R - Rail, O - Other.

Column 4

Point of origin - Enter the location from which the product was transported. (IRS Terminal Code may be substituted in place of origin city and state.)

Column 5

Point of destination - Enter the city and state of the final destination.

Column 6

Terminal Code - Please use the IRS Terminal Code. (This code may be used in place of the origin city and state.)

Columns 7 & 8

Sold to/Purchaser’s FEIN - Enter the name and FEIN of the company to which the product was sold.

Column 9

Date of Manifest.

Column 10

Manifest Number - Enter the manifest/bill of lading number.

Column 11

Gross gallons.

Column 12

Net gallons only. Provide a grand total for this column that can be carried forward to the distributor’s return.

PC - Product Code - Enter the appropriate product code. (If product code not entered on schedule all Diesel Fuel will be considered clear and taxable.)

130 - Jet Fuel

161 - Low Sulphur Diesel #1 - Undyed

227 - Low Sulphur Diesel - Dye Added

150 - No 1 Fuel Oil - Undyed

167 - Low Sulphur Diesel #2 - Undyed

228 - Diesel Fuel - Dye Added

160 - Diesel Fuel - Undyed

226 - High Sulphur Diesel - Dye Added

Other (see FTA Product Code list)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2