Form Jcot 2 - Jessamine County/city Of Nicholasville Net Profit License Fee Return

ADVERTISEMENT

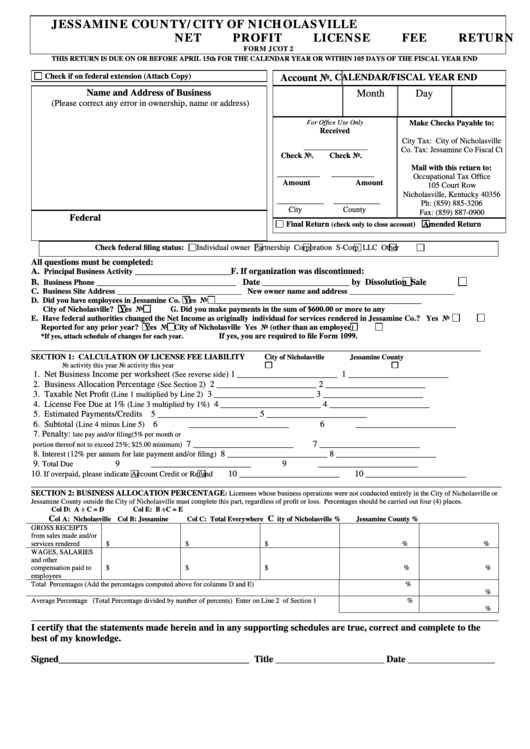

JESSAMINE COUNTY/CITY OF NICHOLASVILLE

NET PROFIT LICENSE FEE RETURN

FORM JCOT 2

THIS RETURN IS DUE ON OR BEFORE APRIL 15th FOR THE CALENDAR YEAR OR WITHIN 105 DAYS OF THE FISCAL YEAR END

Check if on federal extension (Attach Copy)

Account No.

CALENDAR/FISCAL YEAR END

Name and Address of Business

Month

Day

Year

(Please correct any error in ownership, name or address)

For Office Use Only

Make Checks Payable to:

Received

City Tax: City of Nicholasville

__________________

Co. Tax: Jessamine Co Fiscal Ct

Check No.

Check No.

Mail with this return to:

___________

___________

Occupational Tax Office

Amount

Amount

105 Court Row

Nicholasville, Kentucky 40356

____________

____________

Ph: (859) 885-3206

City

County

Fax: (859) 887-0900

Federal I.D. or Social Security Number

Final Return

)

Amended Return

(check only to close account

Check federal filing status:

Individual owner

Partnership

Corporation

S-Corp

LLC

Other

All questions must be completed:

A.

______________________

F. If organization was discontinued:

Principal Business Activity

B.

________________________________

Date ____________________ by

Dissolution

Sale

Business Phone

C. Business Site Address ________________________________

New owner name and address ___________________________

D. Did you have employees in Jessamine Co.

Yes

No

_____________________________________________________

City of Nicholasville?

Yes

No

G. Did you make payments in the sum of $600.00 or more to any

E. Have federal authorities changed the Net Income as originally

individual for services rendered in Jessamine Co.?

Yes

No

Reported for any prior year?

Yes

No

City of Nicholasville

Yes

No (other than an employee)

If yes, you are required to file Form 1099.

*If yes, attach schedule of changes for each year.

________________________________________________________________________________

________

SECTION 1: CALCULATION OF LICENSE FEE LIABILITY

C

ity of Nicholasville

Jessamine County

No activity this year

No activity this year

1. Net Business Income per worksheet

)

1 _______________________

1 _______________________

(See reverse side

2. Business Allocation Percentage

)

2 _______________________

2 _______________________

(See Section 2

3. Taxable Net Profit

3 _______________________

3 _______________________

(Line 1 multiplied by Line 2)

4. License Fee Due at 1%

4 _______________________

4 _______________________

(Line 3 multiplied by 1%)

5. Estimated Payments/Credits

5 _______________________

5 _______________________

6. Subtotal

6 _______________________

6 _______________________

(Line 4 minus Line 5)

7. Penalty:

late pay and/or filing (5% per month or

7 _______________________

7 _______________________

portion thereof not to exceed 25%; $25.00 minimum)

8.

8 _______________________

8 _______________________

Interest (12% per annum for late payment and/or filing)

9.

9 _______________________

9 _______________________

Total Due

10

10 _______________________

10 _______________________

. If overpaid, please indicate

Account Credit or

Refund

____________________________________________________________________________________________________________

SECTION 2: BUSINESS ALLOCATION PERCENTAGE

: Licensees whose business operations were not conducted entirely in the City of Nicholasville or

Jessamine County outside the City of Nicholasville must complete this part, regardless of profit or loss. Percentages should be carried out four (4) places.

Col D: A ÷ C = D

Col E: B ÷C = E

C

C

ol A: Nicholasville

Col B: Jessamine

Col C: Total Everywhere

ity of Nicholasville %

Jessamine County %

GROSS RECEIPTS

from sales made and/or

services rendered

$

$

$

%

%

WAGES, SALARIES

and other

compensation paid to

$

$

$

%

%

employees

Total Percentages (Add the percentages computed above for columns D and E)

%

%

Average Percentage (Total Percentage divided by number of percents) Enter on Line 2 of Section 1

%

%

________________________________________________________________________________________________________________________

I certify that the statements made herein and in any supporting schedules are true, correct and complete to the

best of my knowledge.

Signed ________________________________________ Title

Date

_________________________

____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1