Declaration Of Estimated Tax Form - City Of Pickerington - 2007

ADVERTISEMENT

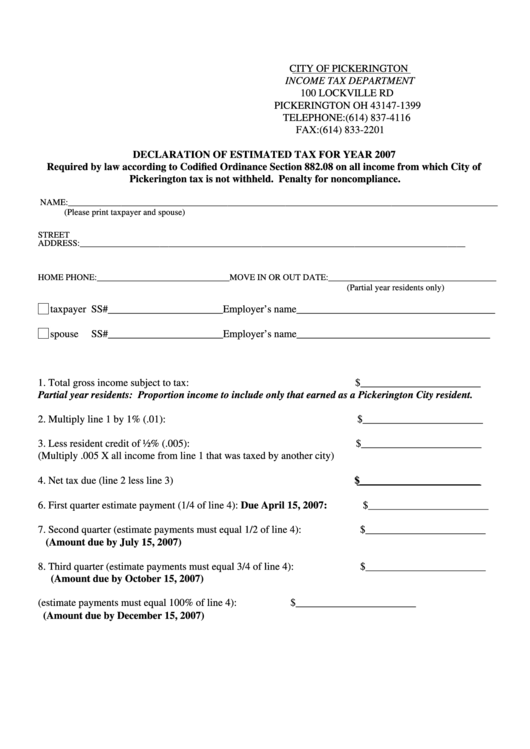

CITY OF PICKERINGTON

INCOME TAX DEPARTMENT

100 LOCKVILLE RD

PICKERINGTON OH 43147-1399

TELEPHONE:(614) 837-4116

FAX:(614) 833-2201

DECLARATION OF ESTIMATED TAX FOR YEAR 2007

Required by law according to Codified Ordinance Section 882.08 on all income from which City of

Pickerington tax is not withheld. Penalty for noncompliance.

NAME:_________________________________________________________________________________________________

(Please print taxpayer and spouse)

STREET

ADDRESS:_______________________________________________________________________________________

HOME PHONE:______________________________MOVE IN OR OUT DATE:______________________________________

(Partial year residents only)

taxpayer SS#______________________Employer’s name______________________________________

spouse

SS#______________________Employer’s name_____________________________________

1. Total gross income subject to tax:

$_______________________

Partial year residents: Proportion income to include only that earned as a Pickerington City resident.

2. Multiply line 1 by 1% (.01):

$_______________________

3. Less resident credit of ½% (.005):

$_______________________

(Multiply .005 X all income from line 1 that was taxed by another city)

4. Net tax due (line 2 less line 3)

$_______________________

6. First quarter estimate payment (1/4 of line 4): Due April 15, 2007:

$_______________________

7. Second quarter (estimate payments must equal 1/2 of line 4):

$_______________________

(Amount due by July 15, 2007)

8. Third quarter (estimate payments must equal 3/4 of line 4):

$_______________________

(Amount due by October 15, 2007)

9.Fourth quarter (estimate payments must equal 100% of line 4):

$_______________________

(Amount due by December 15, 2007)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1