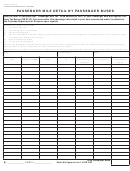

Form Dr 0011 - Passenger Mile Detail By Passenger Buses Page 2

ADVERTISEMENT

BOND REQUIREMENTS

PORT CLEARANCE

A bond will not be required except in

Buses with a passenger capacity of 14 or

those instances when a licensee fails to

less (inclusive of driver) do not have to

file timely reports, when taxes have not

stop and clear Colorado Ports of Entry.

been remitted or when an examination of

the accounts indicates a financial

Commercially licensed buses with more

guarantee is necessary. The bond (if

than a 14 passenger capacity are not

required) must be twice the estimated

required to stop and clear provided that

average net tax liability for the reporting

the bus is legally licensed and registered

period. This bond is to be determined by

to operate in the state of Colorado.

the Department of Revenue.

NOTE: This information does not apply

RECORDKEEPING

to vehicles registered and used as

recreational vehicles.

A complete record of all trips must be

maintained. For audit purposes, all

records must be retained for three years

FURTHER INFORMATION

from the due date of the return or date

filed (whichever is later).

FYIs and commonly used forms are

Each trip must be recorded with the

available on the Web at

following information:

• date of the trip

FYIs provide general information

• vehicle identification number (VIN)

concerning a variety of Colorado tax topics

• origin

in simple and straightforward language.

• destination

Although the FYIs represent a good faith

• miles traveled in Colorado

effort to provide accurate and complete

• number of passengers

tax information, the information is not

• number of passenger miles

binding on the Colorado Department of

Revenue, nor does it replace, alter, or

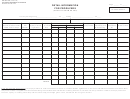

The passenger mile detail of passenger

supersede Colorado law and regulations.

buses (DR 0011) should be used to track

The Executive Director, who by statute is

this information. A copy of the DR 0011 is

the only person having the authority to

attached to this FYI.

bind the Department, has not formally

reviewed and/or approved these FYIs.

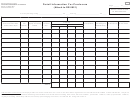

FILING REQUIREMENTS

The Department of Revenue will send you

a quarterly passenger mile tax return (DR

0133). This return will be mailed out

near the end of the quarter and is due by

the end of the following month (i.e., the

return for the period of April – June

would be due July 31).

Failure to receive the form does not

relieve you of your legal responsibility to

file the return by the due date. Notify the

department, if for some reason you do not

receive the form.

PAGE 2 OF 3

EXCISE 14 (04/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3