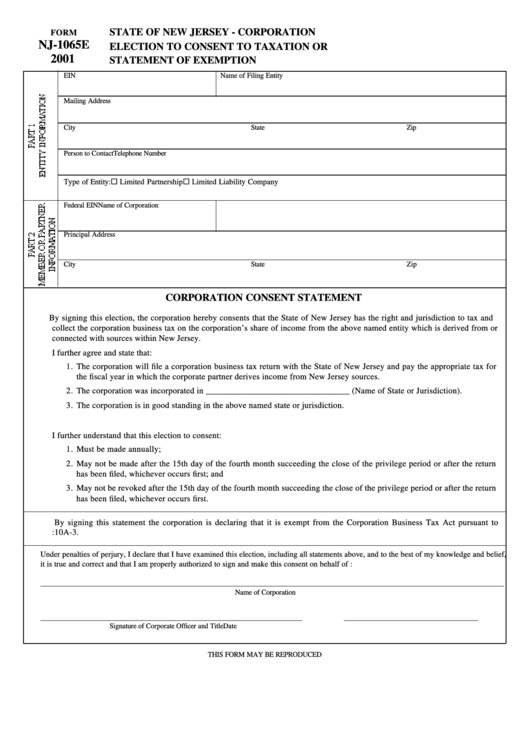

STATE OF NEW JERSEY - CORPORATION

FORM

NJ-1065E

ELECTION TO CONSENT TO TAXATION OR

2001

STATEMENT OF EXEMPTION

EIN

Name of Filing Entity

Mailing Address

City

State

Zip

Person to Contact

Telephone Number

Type of Entity: ¨ Limited Partnership

¨ Limited Liability Company

Federal EIN

Name of Corporation

Principal Address

City

State

Zip

CORPORATION CONSENT STATEMENT

By signing this election, the corporation hereby consents that the State of New Jersey has the right and jurisdiction to tax and

collect the corporation business tax on the corporation’s share of income from the above named entity which is derived from or

connected with sources within New Jersey.

I further agree and state that:

1. The corporation will file a corporation business tax return with the State of New Jersey and pay the appropriate tax for

the fiscal year in which the corporate partner derives income from New Jersey sources.

2. The corporation was incorporated in _________________________________ (Name of State or Jurisdiction).

3. The corporation is in good standing in the above named state or jurisdiction.

I further understand that this election to consent:

1. Must be made annually;

2. May not be made after the 15th day of the fourth month succeeding the close of the privilege period or after the return

has been filed, whichever occurs first; and

3. May not be revoked after the 15th day of the fourth month succeeding the close of the privilege period or after the return

has been filed, whichever occurs first.

By signing this statement the corporation is declaring that it is exempt from the Corporation Business Tax Act pursuant to

N.J.S.A. 54:10A-3.

Under penalties of perjury, I declare that I have examined this election, including all statements above, and to the best of my knowledge and belief,

it is true and correct and that I am properly authorized to sign and make this consent on behalf of :

_______________________________________________________________________________________________________________________

Name of Corporation

__________________________________________________________________________

______________________________________

Signature of Corporate Officer and Title

Date

THIS FORM MAY BE REPRODUCED

1

1