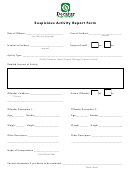

Suspicious Activity Report Form Page 3

Download a blank fillable Suspicious Activity Report Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Suspicious Activity Report Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

!

Part VII

Suspicious Activity Information Explanation/Description

Explanation/description of known or suspected violation of law or

e

Retain any evidence of cover-up or evidence of an attempt

suspicious activity. This section of the report is critical. The care

to deceive federal or state examiners or others.

with which it is written may make the difference in whether or

f

Indicate where the possible violation took place

not the described conduct and its possible criminal nature are

(e.g., main office, branch, other).

clearly understood. Provide below a chronological and complete

g

Indicate whether the possible violation is an isolated

account of the possible violation of law, including what is

incident or relates to other transactions.

unusual, irregular or suspicious about the transaction, using the

h

Indicate whether there is any related litigation; if so,

following checklist as you prepare your account. If necessary,

specify.

continue the narrative on a duplicate of this page.

i

Recommend any further investigation that might assist law

enforcement authorities.

a

Describe supporting documentation and retain for 5 years.

j

Indicate whether any information has been excluded from

b

Explain who benefited, financially or otherwise, from the

this report; if so, why?

transaction, how much, and how.

c

Retain any confession, admission, or explanation of the

For Bank Secrecy Act/Structuring/Money Laundering reports,

transaction provided by the suspect and indicate to

include the following additional information:

whom and when it was given.

d

Retain any confession, admission, or explanation of the

k

Indicate whether currency and/or monetary instruments

transaction provided by any other person and indicate

were involved. If so, provide the amount and/or description.

to whom and when it was given.

l

Indicate any account number that may be involved or

affected.

Paperwork Reduction Act Notice:

The purpose of this form is to provide an effective and consistent means for financial institutions to notify appropriate law enforcement

agencies of known or suspected criminal conduct or suspicious activities that take place at or were perpetrated against financial institutions. This report is required by law,

pursuant to authority contained in the following statutes.

Board of Governors of the Federal Reserve System: 12 U.S.C. 324, 334, 611a, 1844(b) and (c), 3105(c) (2) and

3106(a).

Federal Deposit Insurance Corporation: 12 U.S.C. 93a, 1818, 1881-84, 3401-22. Office of the Comptroller of the Currency: 12 U.S.C. 93a, 1818, 1881-84, 3401-22.

Office of Thrift Supervision: 12 U.S.C. 1463 and 1464. National Credit Union Administration: 12 U.S.C. 1766(a), 1786(q).

Financial Crimes Enforcement Network: 31 U.S.C.

5318(g).

Information collected on this report is confidential (5 U.S.C. 552(b)(7) and 552a(k)(2), and 31 U.S.C. 5318(g)). The Federal financial institutions regulatory agencies

and the U.S. Departments of Justice and Treasury may use and share the information.

Public reporting and recordkeeping burden for this information collection is estimated to

average 36 minutes per response, and includes time to gather and maintain data in the required report, review the instructions, and complete the information collection.

Send

comments regarding this burden estimate, including suggestions for reducing the burden, to the Office of Management and Budget, Paperwork Reduction Project, Washington,

DC 20503 and, depending on your primary Federal regulatory agency, to Secretary, Board of Governors of the Federal Reserve System, Washington, DC 20551; or Assistant

Executive Secretary, Federal Deposit Insurance Corporation, Washington, DC 20429; or Legislative and Regulatory Analysis Division, Office of the Comptroller of the Currency,

Washington, DC 20219; or Office of Thrift Supervision, Enforcement Office, Washington, DC 20552; or National Credit Union Administration, 1775 Duke Street, Alexandria, VA

22314; or Office of the Director, Financial Crimes Enforcement Network, Department of the Treasury, 2070 Chain Bridge Road, Vienna, VA 22182.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3