Precious Metals Tax-Quarterly Estimate Form - South Dakota Department Of Revenue

ADVERTISEMENT

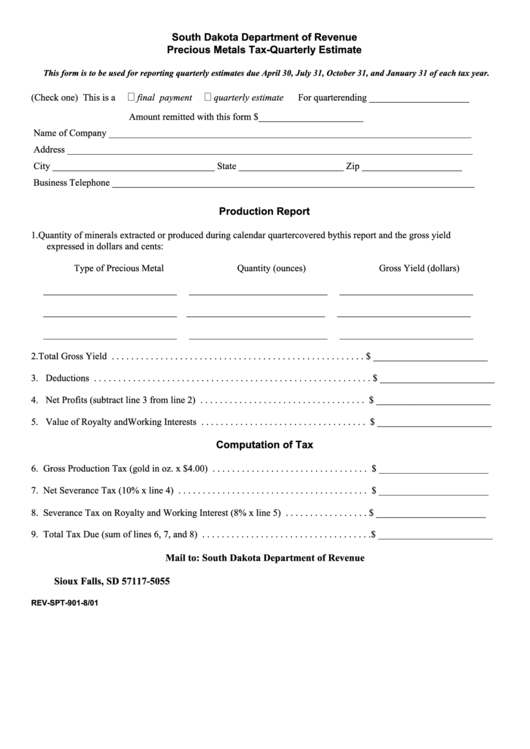

South Dakota Department of Revenue

Precious Metals Tax-Quarterly Estimate

This form is to be used for reporting quarterly estimates due April 30, July 31, October 31, and January 31 of each tax year.

(Check one) This is a

final payment

quarterly estimate

For quarter ending _____________________

Amount remitted with this form $______________________

Name of Company ____________________________________________________________________________

Address _____________________________________________________________________________________

City __________________________________ State ______________________

Zip _____________________

Business Telephone ____________________________________________________________________________

Production Report

1. Quantity of minerals extracted or produced during calendar quarter covered by this report and the gross yield

expressed in dollars and cents:

Type of Precious Metal

Quantity (ounces)

Gross Yield (dollars)

____________________________

_____________________________

____________________________

____________________________

_____________________________

____________________________

____________________________

_____________________________

____________________________

2. Total Gross Yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ________________________

3. Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ________________________

4. Net Profits (subtract line 3 from line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ________________________

5. Value of Royalty and Working Interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ________________________

Computation of Tax

6. Gross Production Tax (gold in oz. x $4.00) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

7. Net Severance Tax (10% x line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

8. Severance Tax on Royalty and Working Interest (8% x line 5) . . . . . . . . . . . . . . . . . $ _______________________

9. Total Tax Due (sum of lines 6, 7, and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ________________________

Mail to: South Dakota Department of Revenue

P.O. Box 5055

Sioux Falls, SD 57117-5055

REV-SPT-901-8/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1