Form 2010 Lw-3 - Employer'S Annual Reconciliation Of Income Tax Withheld

ADVERTISEMENT

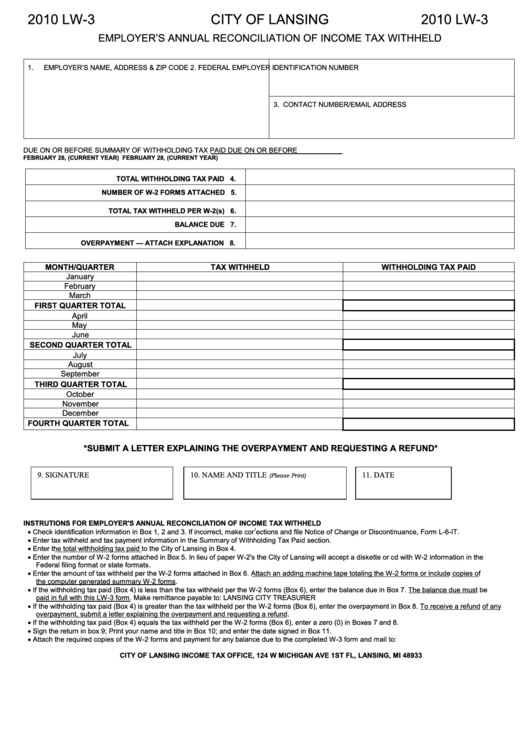

2010 LW-3

CITY OF LANSING

2010 LW-3

EMPLOYER’S ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

1.

EMPLOYER’S NAME, ADDRESS & ZIP CODE

2. FEDERAL EMPLOYER IDENTIFICATION NUMBER

3. CONTACT NUMBER/EMAIL ADDRESS

DUE ON OR BEFORE

SUMMARY OF WITHHOLDING TAX PAID

DUE ON OR BEFORE

FEBRUARY 28, (CURRENT YEAR)

FEBRUARY 28, (CURRENT YEAR)

TOTAL WITHHOLDING TAX PAID

4.

NUMBER OF W-2 FORMS ATTACHED

5.

TOTAL TAX WITHHELD PER W-2(s)

6.

BALANCE DUE

7.

OVERPAYMENT — ATTACH EXPLANATION

8.

MONTH/QUARTER

TAX WITHHELD

WITHHOLDING TAX PAID

January

February

March

FIRST QUARTER TOTAL

April

May

June

SECOND QUARTER TOTAL

July

August

September

THIRD QUARTER TOTAL

October

November

December

FOURTH QUARTER TOTAL

*SUBMIT A LETTER EXPLAINING THE OVERPAYMENT AND REQUESTING A REFUND*

9. SIGNATURE

10. NAME AND TITLE

11. DATE

(Please Print)

INSTRUTIONS FOR EMPLOYER'S ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

r

• Check identification information in Box 1, 2 and 3. If incorrect, make cor

ections and file Notice of Change or Discontinuance, Form L-6-IT.

• Enter tax withheld and tax payment information in the Summary of Withholding Tax Paid section.

• Enter the total withholding tax paid to the City of Lansing in Box 4.

• Enter the number of W-2 forms attached in Box 5. In lieu of paper W-2's the City of Lansing will accept a diskette or cd with W-2 information in the

Federal filing format or state formats.

• Enter the amount of tax withheld per the W-2 forms attached in Box 6. Attach an adding machine tape totaling the W-2 forms or include copies of

the computer generated summary W-2 forms.

• If the withholding tax paid (Box 4) is less than the tax withheld per the W-2 forms (Box 6), enter the balance due in Box 7. The balance due must be

paid in full with this LW-3 form. Make remittance payable to: LANSING CITY TREASURER

• If the withholding tax paid (Box 4) is greater than the tax withheld per the W-2 forms (Box 6), enter the overpayment in Box 8. To receive a refund of any

overpayment, submit a letter explaining the overpayment and requesting a refund.

• If the withholding tax paid (Box 4) equals the tax withheld per the W-2 forms (Box 6), enter a zero (0) in Boxes 7 and 8.

• Sign the return in box 9; Print your name and title in Box 10; and enter the date signed in Box 11.

• Attach the required copies of the W-2 forms and payment for any balance due to the completed W-3 form and mail to:

CITY OF LANSING INCOME TAX OFFICE, 124 W MICHIGAN AVE 1ST FL, LANSING, MI 48933

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1