Form 120-16-Ec - Cca-Municipal Income Tax

ADVERTISEMENT

▲

▲

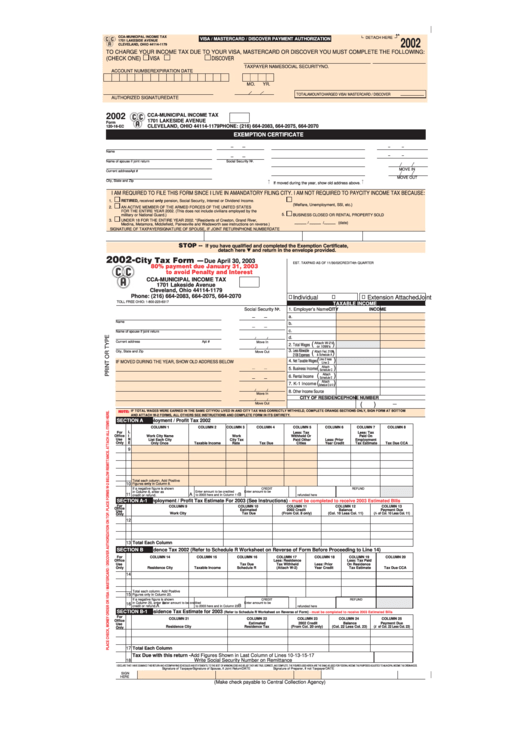

CCA-MUNICIPAL INCOME TAX

DETACH HERE

VISA / MASTERCARD / DISCOVER PAYMENT AUTHORIZATION

2002

1701 LAKESIDE AVENUE

CLEVELAND, OHIO 44114-1179

TO CHARGE YOUR INCOME TAX DUE TO YOUR VISA, MASTERCARD OR DISCOVER YOU MUST COMPLETE THE FOLLOWING:

(CHECK ONE)

VISA

DISCOVER

TAXPAYER NAME

SOCIAL SECURITY NO.

ACCOUNT NUMBER

EXPIRATION DATE

MO.

YR.

TOTAL AMOUNT CHARGED VISA / MASTERCARD / DISCOVER

AUTHORIZED SIGNATURE

DATE

2002

CCA-MUNICIPAL INCOME TAX

1701 LAKESIDE AVENUE

Form

CLEVELAND, OHIO 44114-1179 PHONE: (216) 664-2083, 664-2075, 664-2070

120-16-EC

EXEMPTION CERTIFICATE

Name

Name of spouse if joint return

Social Security No.

MOVE IN

Current address

Apt #

MOVE OUT

City, State and Zip

If moved during the year, show old address above.

I AM REQUIRED TO FILE THIS FORM SINCE I LIVE IN A MANDATORY FILING CITY. I AM NOT REQUIRED TO PAY CITY INCOME TAX BECAUSE:

1.

RETIRED, received only pension, Social Security, Interest or Dividend Income.

4.

NO EARNED INCOME FOR THE ENTIRE YEAR 2002.

(Welfare, Unemployment, SSI, etc.)

2.

AN ACTIVE MEMBER OF THE ARMED FORCES OF THE UNITED STATES

FOR THE ENTIRE YEAR 2002. (This does not include civilians employed by the

5.

military or National Guard.)

BUSINESS CLOSED OR RENTAL PROPERTY SOLD

3.

UNDER 18 FOR THE ENTIRE YEAR 2002. *(Residents of Creston, Grand River,

/

/

(date)

Medina, Metamora, Middlefield, Painesville and Wadsworth see instructions on reverse.)

SIGNATURE OF TAXPAYER

SIGNATURE OF SPOUSE, IF JOINT RETURN

PHONE NUMBER

DATE

STOP --

If you have qualified and completed the Exemption Certificate,

detach here ▼ and return in the envelope provided.

2002-

City Tax Form —

Due April 30, 2003

EST. TAX

PAID AS OF 11/30/02

CREDIT

4th QUARTER

80% payment due January 31, 2003

to avoid Penalty and Interest

CCA-MUNICIPAL INCOME TAX

1701 Lakeside Avenue

Cleveland, Ohio 44114-1179

Phone: (216) 664-2083, 664-2075, 664-2070

Individual

Joint

Extension Attached

TOLL FREE OHIO: 1-800-223-6317

CCA FORM 120-16-IR

TAXABLE INCOME

Social Security No.

1. Employer’s Name

CITY

INCOME

a.

Name

b.

c.

Name of spouse if joint return

d.

Current address

Apt #

Move In

(

Attach W-2’s

)

2. Total Wages

or 1099’s

3. Less Allowable

City, State and Zip

(

)

Move Out

Attach Fed. 2106

2106 Expenses

& Schedule A

(

)

Line 2 less

4. Net Taxable Wages

IF MOVED DURING THE YEAR, SHOW OLD ADDRESS BELOW

Line 3

(

Attach

)

5. Business Income

Schedule C

(

)

Attach

6. Rental Income

Schedule E

(

Attach

)

7. K-1 Income

Schedule E & K-1

8. Other Income Source

Move In

CITY OF RESIDENCE

PHONE NUMBER

(

)

Move Out

IF TOTAL WAGES WERE EARNED IN THE SAME CITY YOU LIVED IN AND CITY TAX WAS CORRECTLY WITHHELD, COMPLETE ORANGE SECTIONS ONLY, SIGN FORM AT BOTTOM

NOTE:

AND ATTACH W-2 FORMS, ALL OTHERS SEE INSTRUCTIONS AND COMPLETE FORM IN ITS ENTIRETY.

SECTION A

Employment / Profit Tax 2002

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

COLUMN 6

COLUMN 7

COLUMN 8

For

L

Less: Tax

Less: Tax

Office

I

Work City Name

Work

Withheld Or

Paid On

Use

N

List Each City

City Tax

Paid Other

Less: Prior

Employment

E

Only

Only Once

Taxable Income

Rate

Tax Due

Cities

Year Credit

Tax Estimate

Tax Due CCA

9

Total each column. Add Positive

10

Figures only in Column 8.

If a negative figure is shown

CREDIT

REFUND

in Column 8, enter as

Enter amount to be credited

Enter amount to be

11

A

B

credit or refund.

to 2003 here and in Column 11

refunded here

SECTION A-1

Employment / Profit Tax Estimate For 2003 (See Instructions)

- must be completed to receive 2003 Estimated Bills

For

COLUMN 9

COLUMN 10

COLUMN 11

COLUMN 12

COLUMN 13

Office

Estimated

2002 Credit

Balance

Payment Due

Use

Work City

Tax Due

(From Col. 8 only)

(Col. 10 Less Col. 11)

(

1

⁄

of Col. 10 Less Col. 11)

Only

4

12

13 Total Each Column

SECTION B

Residence Tax 2002 (Refer to Schedule R Worksheet on Reverse of Form Before Proceeding to Line 14)

For

COLUMN 14

COLUMN 15

COLUMN 16

COLUMN 17

COLUMN 18

COLUMN 19

COLUMN 20

Office

Less: Residence

Less: Tax Paid

Use

Tax Due

Tax Withheld

Less: Prior

On Residence

Only

Residence City

Taxable Income

Schedule R

(Attach W-2)

Year Credit

Tax Estimate

Tax Due CCA

14

Total each column. Add Positive

15

Figures only in Column 20.

If a negative figure is shown

CREDIT

REFUND

in Column 20, enter as

Enter amount to be credited

Enter amount to be

16

A

B

credit or refund.

to 2003 here and in Column 23

refunded here

SECTION B-1

Residence Tax Estimate for 2003

(Refer to Schedule R Worksheet on Reverse of Form)

- must be completed to receive 2003 Estimated Bills

For

COLUMN 21

COLUMN 22

COLUMN 23

COLUMN 24

COLUMN 25

Office

Estimated

2002 Credit

Balance

Payment Due

Use

Residence City

Residence Tax

(From Col. 20 only)

(Col. 22 Less Col. 23)

(

1

⁄

of Col. 22 Less Col. 23)

Only

4

17 Total Each Column

Tax Due with this return - Add Figures Shown in Last Column of Lines 10-13-15-17

18

Write Social Security Number on Remittance

I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS. TO THE BEST OF MY KNOWLEDGE AND BELIEF THEY ARE TRUE, CORRECT, AND COMPLETE. THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES ADJUSTED TO MUNICIPAL INCOME TAX ORDINANCES.

Signature of Taxpayer

Signature of Spouse, if Joint Return

DATE

Signature of Preparer, If not Taxpayer

DATE

SIGN

HERE

(Make check payable to Central Collection Agency)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1