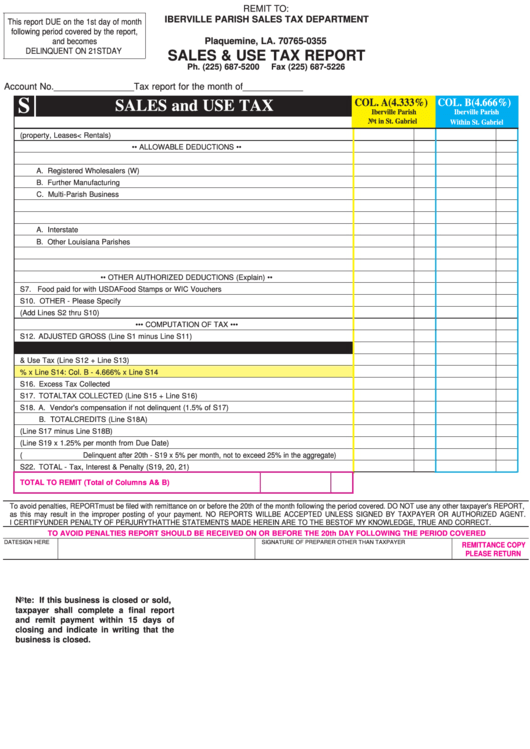

Sales & Use Tax Report Form

ADVERTISEMENT

REMIT TO:

IBERVILLE PARISH SALES TAX DEPARTMENT

This report DUE on the 1st day of month

P.O. Box 355

following period covered by the report,

Plaquemine, LA. 70765-0355

and becomes

DELINQUENT ON 21ST DAY

SALES & USE TAX REPORT

Ph. (225) 687-5200

Fax (225) 687-5226

Account No.________________

Tax report for the month of____________

S

COL. A (4.333%)

COL. B (4.666%)

SALES and USE TAX

Iberville Parish

Iberville Parish

Not in St. Gabriel

Within St. Gabriel

S1. GROSS SALES (property, Leases< Rentals)

•• ALLOWABLE DEDUCTIONS ••

S2. Sales for Resale

A. Registered Wholesalers (W)

B. Further Manufacturing

C. Multi-Parish Business

S3. Cash Discounts / Sales Returns / Allowances

S4. Sales delivered / shipped outside Iberville Parish

A. Interstate

B. Other Louisiana Parishes

S5. Sales of gasoline / motor fuel

S6. Government sales - U.S. / Louisiana / Iberville Parish / Governmental Agencies

•• OTHER AUTHORIZED DEDUCTIONS (Explain) ••

S7. Food paid for with USDA Food Stamps or WIC Vouchers

S10. OTHER - Please Specify

S11. TOTAL DEDUCTIONS (Add Lines S2 thru S10)

••• COMPUTATION OF TAX •••

S12. ADJUSTED GROSS (Line S1 minus Line S11)

S13. Purchases Subject to Use Tax

S14. TOTAL subject to Sales & Use Tax (Line S12 + Line S13)

S15. TAX - Col. A - 4.333% x Line S14: Col. B - 4.666% x Line S14

S16. Excess Tax Collected

S17. TOTAL TAX COLLECTED (Line S15 + Line S16)

S18. A. Vendor's compensation if not delinquent (1.5% of S17)

B. TOTAL CREDITS (Line S18A)

S19. NET TAX PAYABLE (Line S17 minus Line S18B)

S20. INTEREST (Line S19 x 1.25% per month from Due Date)

S21. PENALTIES (Delinquent after 20th - S19 x 5% per month, not to exceed 25% in the aggregate)

S22. TOTAL - Tax, Interest & Penalty (S19, 20, 21)

TOTAL TO REMIT (Total of Columns A & B)

To avoid penalties, REPORT must be filed with remittance on or before the 20th of the month following the period covered. DO NOT use any other taxpayer's REPORT,

as this may result in the improper posting of your payment. NO REPORTS WILL BE ACCEPTED UNLESS SIGNED BY TAXPAYER OR AUTHORIZED AGENT.

I CERTIFY UNDER PENALTY OF PERJURY THAT THE STATEMENTS MADE HEREIN ARE TO THE BEST OF MY KNOWLEDGE, TRUE AND CORRECT.

TO AVOID PENALTIES REPORT SHOULD BE RECEIVED ON OR BEFORE THE 20th DAY FOLLOWING THE PERIOD COVERED

DATE

SIGN HERE

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

REMITTANCE COPY

PLEASE RETURN

Note: If this business is closed or sold,

taxpayer shall complete a final report

and remit payment within 15 days of

closing and indicate in writing that the

business is closed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1