Form 50-142 (Rev.8-97/2)(Back)

[Ren. V 22.02]

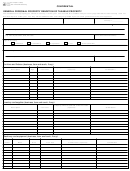

Vehicles (including automobiles used for the production of income, motor homes, motorcycles, travel trailers, watercraft, aircraft, etc.):

Year

Body

Current license no. and /

Property owner's estimate of

model

Make

type

or vehicle I.D. number

market value (optional)*

Jurisdictions

NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised

value greater than the rendered value is to be submitted to the appraisal review board. Property owners may

protest appraised values before the appraisal review board. (Tex. Property Tax Code, Sec. 25.19)

I affirm that the information contained in this report is accurate and complete to the best of my knowledge and belief, and complete

information necessary to identify the property, to determine its ownership, taxability and situs will be made available for inspection

to employees of the appraisal district on request.

Company name

Title

Are you the property owner, an employee of the property owner, or acting on behalf of an affiliated entity of the property owner?

Yes

No

The application must be signed and dated. By signing this document, you attest that the information contained on it is true and

correct to the best of your knowledge and belief. If you checked “Yes” above, sign and date the application.

sign

Signature

here

__________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and accurate.

sign

Signature

here

__________________________________________________________________ Date _________________

I attest that the individual signing above subscribed and swore to the accuracy and truth of the information provided on this form

before me, this the ______ day of ________________ , ______ .

_________________________________________

Notary Public

Section 22.26 of the Propery Tax Code states:

(a) Each rendition statement or property report required or authorized by this chapter must be signed by an individual

who is required to file the statement or report.

(b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent

who has been designated in writing by the board of directors or by an authorized officer to sign in behalf of the

corporation must sign this statement or report.

1

1 2

2