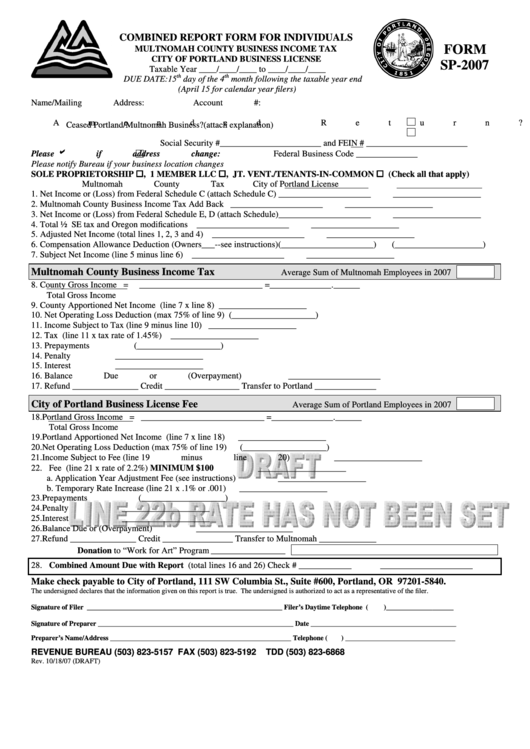

Form Sp-2007 Draft - Combined Report Form For Individuals Multnomah County Business Income Tax City Of Portland Business License

ADVERTISEMENT

COMBINED REPORT FORM FOR INDIVIDUALS

FORM

MULTNOMAH COUNTY BUSINESS INCOME TAX

CITY OF PORTLAND BUSINESS LICENSE

SP-2007

Taxable Year ____/____/____ to ____/____/____

th

th

DUE DATE:15

day of the 4

month following the taxable year end

(April 15 for calendar year filers)

Name/Mailing Address:

Account #:

Amended Return?

Ceased Portland/Multnomah Business?

(attach explanation)

Social Security #_______________________ and FEIN # _______________________

b

Please

if address change:

Federal Business Code ______________

Please notify Bureau if your business location changes

SOLE PROPRIETORSHIP

, 1 MEMBER LLC

, JT. VENT./TENANTS-IN-COMMON

(Check all that apply)

Multnomah County Tax

City of Portland License

1. Net Income or (Loss) from Federal Schedule C (attach Schedule C) _____________________

____________________

2. Multnomah County Business Income Tax Add Back

_____________________

____________________

3. Net Income or (Loss) from Federal Schedule E, D (attach Schedule)_____________________

____________________

4. Total ½ SE tax and Oregon modifications

_____________________

____________________

5. Adjusted Net Income (total lines 1, 2, 3 and 4)

_____________________

____________________

6. Compensation Allowance Deduction (Owners___--see instructions)(_____________________)

(____________________)

7. Subject Net Income (line 5 minus line 6)

_____________________

____________________

Multnomah County Business Income Tax

Average Sum of Multnomah Employees in 2007

8. County Gross Income =

____________________________ =______________.______

Total Gross Income

9. County Apportioned Net Income (line 7 x line 8)

____________________

10. Net Operating Loss Deduction (max 75% of line 9)

(___________________)

11. Income Subject to Tax (line 9 minus line 10)

____________________

12. Tax (line 11 x tax rate of 1.45%)

____________________

13. Prepayments

(___________________)

14. Penalty

____________________

15. Interest

____________________

16. Balance Due or (Overpayment)

_____________________

17. Refund _______________ Credit _________________ Transfer to Portland ______________

City of Portland Business License Fee

Average Sum of Portland Employees in 2007

18. Portland Gross Income = ____________________________ =______________.______

Total Gross Income

19. Portland Apportioned Net Income (line 7 x line 18)

____________________

20. Net Operating Loss Deduction (max 75% of line 19)

(___________________)

21. Income Subject to Fee (line 19 minus line 20)

____________________

22. Fee (line 21 x rate of 2.2%) MINIMUM $100

____________________

a. Application Year Adjustment Fee (see instructions)

____________________

b. Temporary Rate Increase (line 21 x .1% or .001)

____________________

23. Prepayments

(___________________)

24. Penalty

____________________

25. Interest

____________________

26. Balance Due or (Overpayment)

______________________

27. Refund _______________ Credit ________________ Transfer to Multnomah _____________

Donation to “Work for Art” Program

_____________________

28. Combined Amount Due with Report (total lines 16 and 26) Check # ____________

_____________________

Make check payable to City of Portland, 111 SW Columbia St., Suite #600, Portland, OR 97201-5840.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer.

Signature of Filer _______________________________________________________ Filer’s Daytime Telephone (

)___________________

Signature of Preparer _______________________________________________________ Date _________________________________________

Preparer’s Name/Address ___________________________________________________ Telephone (

) _______________________________

REVENUE BUREAU (503) 823-5157

FAX (503) 823-5192

TDD (503) 823-6868

Rev. 10/18/07 (DRAFT)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2