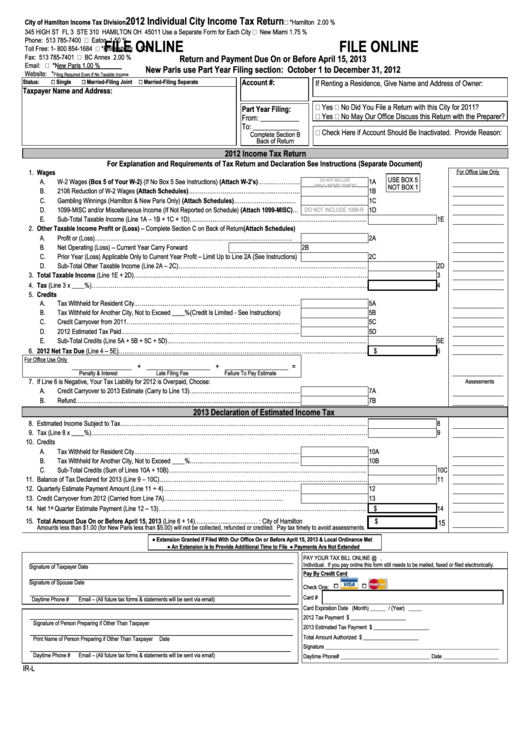

Form Ir-L - Individual City Income Tax Return - 2012

ADVERTISEMENT

2012 Individual City Income Tax Return

City of Hamilton Income Tax Division

*Hamilton .................. 2.00 %

345 HIGH ST FL 3 STE 310 HAMILTON OH 45011

Use a Separate Form for Each City

New Miami............... 1.75 %

Phone:

513 785-7400

Eaton ....................... 1.50 %

FILE ONLINE

FILE ONLINE

Toll Free: 1- 800 854-1684

*Phillipsburg ............. 1.50 %

Fax:

513 785-7401

BC Annex ................ 2.00 %

Return and Payment Due On or Before April 15, 2013

Email:

citytax@ci.hamilton.oh.us

*New Paris............... 1.00 %

New Paris use Part Year Filing section: October 1 to December 31, 2012

Website:

*

Filing Required Even If No Taxable Income

Status:

Single

Married-Filing Joint

Married-Filing Separate

Account #:

If Renting a Residence, Give Name and Address of Owner:

Taxpayer Name and Address:

Yes

No Did You File a Return with this City for 2011?

Part Year Filing:

Yes

No May Our Office Discuss this Return with the Preparer?

From: ___________

To: _____________

Check Here if Account Should Be Inactivated. Provide Reason:

Complete Section B

Back of Return

2012 Income Tax Return

For Explanation and Requirements of Tax Return and Declaration See Instructions (Separate Document)

1. Wages

For Office Use Only

USE BOX 5

A.

W-2 Wages (Box 5 of Your W-2) (If No Box 5 See Instructions) (Attach W-2’s)……...…………..

1A

DO NOT INCLUDE

1099-G UNEMPLOYMENT

NOT BOX 1

B.

2106 Reduction of W-2 Wages (Attach Schedules)……………………………………..……………

1B

do

C.

Gambling Winnings (Hamilton & New Paris Only) (Attach Schedules)……………………..….…

1C

D.

1099-MISC and/or Miscellaneous Income (If Not Reported on Schedule) (Attach 1099-MISC)…

DO NOT INCLUDE 1099-R

1D

E.

Sub-Total Taxable Income (Line 1A – 1B + 1C + 1D)………………………………………………………………………………...

1E

2. Other Taxable Income Profit or (Loss) – Complete Section C on Back of Return (Attach Schedules)

…………………………..…………..

A.

Profit or (Loss)……………………………………………….……………….…………………………....

2A

B.

Net Operating (Loss) – Current Year Carry Forward

2B

C.

Prior Year (Loss) Applicable Only to Current Year Profit – Limit Up to Line 2A (See Instructions)

2C

D.

Sub-Total Other Taxable Income (Line 2A – 2C)……………………………………………………………………………………...

2D

3. Total Taxable Income (Line 1E + 2D)……………………………………………………………………………………………………………

3

……………………………..

4. Tax (Line 3 x ____%)………………….….……………………………………………………………………………………………………...…

4

……………………………...

5. Credits

……………………………...

A.

Tax Withheld for Resident City……………………………………………………………………………

5A

B.

Tax Withheld for Another City, Not to Exceed ____% (Credit Is Limited - See Instructions)

5B

C.

Credit Carryover from 2011…………………………………………………………….…………………

5C

D.

2012 Estimated Tax Paid…...……………………………………………………………………..……...

5D

E.

Sub-Total Credits (Line 5A + 5B + 5C + 5D)…………………………………………………………………………………………...

5E

6. 2012 Net Tax Due (Line 4 – 5E)…………………………………………………………………………………………………………………..

$

6

……………………………...

For Office Use Only

……………………………...

_________________ + __________________ + __________________ =

Penalty & Interest

Late Filing Fee

Failure To Pay Estimate

7. If Line 6 is Negative, Your Tax Liability for 2012 is Overpaid, Choose:

Assessments

A.

Credit Carryover to 2013 Estimate (Carry to Line 13)………………………………………………….

7A

B.

Refund………………………………………………………………………………………………………..

7B

2013 Declaration of Estimated Income Tax

.

8. Estimated Income Subject to Tax………………………………..………………………………………………………………………………..

8

9. Tax (Line 8 x ____%)…………………………………………………………………………….…………………………………………………

9

……………………………...

10. Credits

……………………………...

A.

Tax Withheld for Resident City……………………………………………………………………………

10A

B.

Tax Withheld for Another City, Not to Exceed ____%………………..………………………………..

10B

C.

Sub-Total Credits (Sum of Lines 10A + 10B)…………………………………………………………………………………………..

10C

11. Balance of Tax Declared for 2013 (Line 9 – 10C)……………………………………………………………………………………………….

11

……………………………...

12. Quarterly Estimate Payment Amount (Line 11 ÷ 4).…………………………………………………….…….…

12

……………………………...

13. Credit Carryover from 2012 (Carried from Line 7A)……………………………………………………...

13

14. Net 1

Quarter Estimate Payment (Line 12 – 13)……………………………………………………………………………………………….

$

14

st

……………………………...

15. Total Amount Due On or Before April 15, 2013 (Line 6 + 14)..……..……...……………..Make Check Payable To: City of Hamilton

$

15

Amounts less than $1.00 (for New Paris less than $5.00) will not be collected, refunded or credited. Pay tax timely to avoid assessments.

Extension Granted if Filed With Our Office On or Before April 15, 2013 & Local Ordinance Met

An Extension is to Provide Additional Time to File Payments Are Not Extended

____________________________________________________________

PAY YOUR TAX BILL ONLINE @ Choose Manage My Account,

Individual. If you pay online this form still needs to be mailed, faxed or filed electronically.

Signature of Taxpayer

Date

____________________________________________________________

Pay By Credit Card

Signature of Spouse

Date

Check One:

_______________________ ___________________________________

Card #

Daytime Phone #

Email – (All future tax forms & statements will be sent via email)

Card Expiration Date .......................................................... (Month) ______ / (Year) _____

____________________________________________________________

2012 Tax Payment ......................................................................... $ _____________________

Signature of Person Preparing if Other Than Taxpayer

2013 Estimated Tax Payment ....................................................... $ _____________________

____________________________________________________________

Total Amount Authorized ............................................................... $ _____________________

Print Name of Person Preparing if Other Than Taxpayer

Date

_______________________ ___________________________________

Signature __________________________________________________________________

Daytime Phone #

Email – (All future tax forms & statements will be sent via email)

Daytime Phone# __________________________________ Date _____________________

IR-L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2