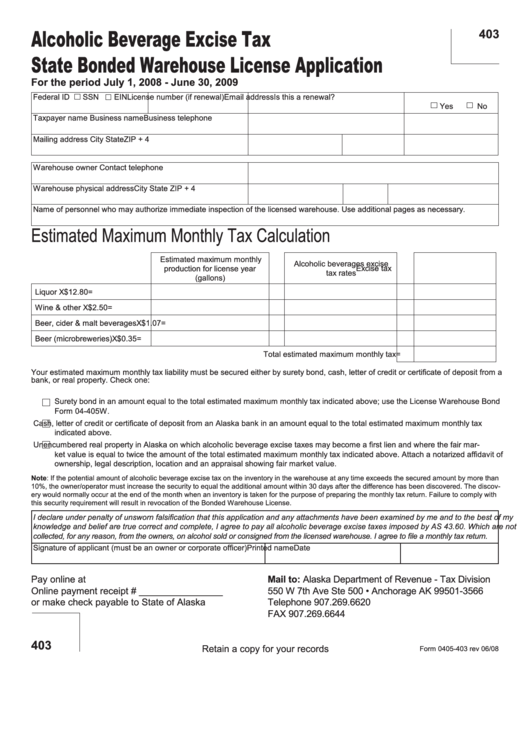

Form 0405-403 - Alcoholic Beverage Excise Tax State Bonded Warehouse License Application - 2008

ADVERTISEMENT

Alcoholic Beverage Excise Tax

403

State Bonded Warehouse License Application

For the period July 1, 2008 - June 30, 2009

Federal ID

SSN

EIN

License number (if renewal) Email address

Is this a renewal?

Yes

No

Taxpayer name

Business name

Business telephone

Mailing address

City

State

ZIP + 4

Warehouse owner

Contact telephone

Warehouse physical address

City

State

ZIP + 4

Name of personnel who may authorize immediate inspection of the licensed warehouse. Use additional pages as necessary.

Estimated Maximum Monthly Tax Calculation

Estimated maximum monthly

Alcoholic beverages excise

production for license year

Excise tax

tax rates

(gallons)

Liquor

X

$12.80

=

Wine & other

X

$2.50

=

Beer, cider & malt beverages

X

$1.07

=

Beer (microbreweries)

X

$0.35

=

Total estimated maximum monthly tax

=

Your estimated maximum monthly tax liability must be secured either by surety bond, cash, letter of credit or certificate of deposit from a

bank, or real property. Check one:

Surety bond in an amount equal to the total estimated maximum monthly tax indicated above; use the License Warehouse Bond

Form 04-405W.

Cash, letter of credit or certificate of deposit from an Alaska bank in an amount equal to the total estimated maximum monthly tax

indicated above.

Unencumbered real property in Alaska on which alcoholic beverage excise taxes may become a first lien and where the fair mar-

ket value is equal to twice the amount of the total estimated maximum monthly tax indicated above. Attach a notarized affidavit of

ownership, legal description, location and an appraisal showing fair market value.

Note: If the potential amount of alcoholic beverage excise tax on the inventory in the warehouse at any time exceeds the secured amount by more than

10%, the owner/operator must increase the security to equal the additional amount within 30 days after the difference has been discovered. The discov-

ery would normally occur at the end of the month when an inventory is taken for the purpose of preparing the monthly tax return. Failure to comply with

this security requirement will result in revocation of the Bonded Warehouse License.

I declare under penalty of unsworn falsification that this application and any attachments have been examined by me and to the best of my

knowledge and belief are true correct and complete, I agree to pay all alcoholic beverage excise taxes imposed by AS 43.60. Which are not

collected, for any reason, from the owners, on alcohol sold or consigned from the licensed warehouse. I agree to file a monthly tax return.

Signature of applicant (must be an owner or corporate officer)

Printed name

Date

Pay online at

Mail to: Alaska Department of Revenue - Tax Division

Online payment receipt # ________________

550 W 7th Ave Ste 500 • Anchorage AK 99501-3566

or make check payable to State of Alaska

Telephone 907.269.6620

FAX 907.269.6644

dor.tax.alcohol@alaska.gov

403

Retain a copy for your records

Form 0405-403 rev 06/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1