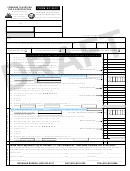

Form P-2010 Draft - Combined Tax Return For Partnerships - 2010 Page 2

ADVERTISEMENT

The Revenue Bureau administers both the City of Portland Business License Tax Program and the Multnomah County Business

Income Tax Program. Request further information or forms as needed from the Bureau at 111 SW Columbia, Suite #600, Portland,

OR 97201-5840 or go to

INSTRUCTIONS FOR PARTNERSHIP, LP, LLC, LLP, JOINT VENTURE

OR TENANTS IN COMMON/ENTIRETY RETURN - 2010

Note: Please enter your business code below your FEIN. You may find this code in Section C of page 1 of federal Form 1065.

1.

Ordinary income is income before distribution to partners, on federal Form 1065, line 22. If a joint venture or tenants-in-common elect to not

file as partnership, please combine individual net incomes from the joint venture or rental activities on line 1.

2.

Add back Multnomah County and City of Portland business income/license tax and other taxes measured by net income deducted to arrive at

net income (line 1).

3.

Add (subtract) Schedule K lines 2-3 and 5-13. Also add (subtract) any Oregon modifications related to business and other pass-through income

(loss) by entities already licensed/taxed by Portland/Multnomah County.

4.

Add all compensation (guaranteed payments, interest, wages and salary) paid to partners. Enter number of general partners and limited partners

paid compensation and/or interest. Members of LLCs shall be deemed general or limited partners by Bureau written policy (available by

contacting the Audit Section of the Revenue Bureau).

6.

A deduction of up to 75% of the total income (line 5) is allowed for general partnerships but cannot exceed $84,000 per general partner listed

on line 4. General partners who are owners of capital in a limited partnership are allowed this deduction regardless of direct compensation paid.

However, deductions for limited partners cannot exceed limited partner compensation included on line 4. No deduction is allowed if line 5 is a

loss.

Apportionment (line 8 and line 18) Multiple factor apportionment methods are not allowed.

Gross income includes all income (gross receipts, service income, interest, dividends, income from contractual agreements, gross rents and gains on

sale of business property) from activity within the City or County. With few exceptions, income in the City is also in Multnomah County. Income

may be apportioned only if there is regular business activity outside the City/County. Services performed outside the City/County may be

apportioned based upon percentage of performance outside the applicable jurisdiction. Sales of tangible personal property may be apportioned only

.

if a business has payroll or property outside the jurisdiction

MULTNOMAH COUNTY BUSINESS INCOME TAX

Multnomah Employees: Enter average sum of full-time and part-time employees working in Multnomah County during tax year.

8.

County gross income includes income from all activity within the County (see apportionment instructions above). Enter the gross income

within the County as the numerator of the fraction and gross income everywhere as the denominator of the fraction. Divide to determine the

percentage of Subject Net Income to apportion to Multnomah County. Round apportionment percentages to six places (xx.xxxx% or .xxxxxx).

10. Net Operating Losses (as previously reported on line 9 of prior combined returns) are allowed a maximum carryforward of five (5)

years. The annual deduction cannot exceed 75% of the apportioned income for the current year.

Enter all prepayments (quarterly, extension payments and credit carried forward from prior years).

13.

14. Enter all late and/or underpayment penalties that apply (see penalty calculation instructions below).

15. Interest on taxes not paid by the original due date (April 15 for calendar year taxpayers) is calculated at 10% per annum (.00833 x no. of

months). Calculate interest from original due date to the 15th day of the month following the date of payment.

16. Total lines 12, 13, 14 and 15 to determine balance due or (overpayment) for Multnomah County Business Income Tax.

17. Overpayments may be refunded, credited forward or transferred between programs.

Penalty calculation (line 14 and line 24)

A penalty of 10% (5% late penalty plus 5% underpayment penalty) of the tax must be added if the report and tax are filed and paid past the

due date. An additional penalty of 20% of the tax must be added if the report is more than four months past due. Any report which is

delinquent three or more consecutive years accrues an additional 100% of the tax as penalty. No late penalty is due if a timely

extension is filed with the Bureau and a return is filed by the extended due date. No underpayment penalty is due if a timely prepayment is made

which is at least 90% of the total tax on line 12 (County) and at least 90% of the tax on line 22 (City), or 100% of the prior year’s tax.

CITY OF PORTLAND BUSINESS LICENSE TAX

Portland Employees:

Enter average sum of full-time and part-time employees working in Portland during tax year.

18. Portland gross income includes income from all activity within Portland (see apportionment instructions above). Enter the gross income within

Portland as the numerator of the fraction and gross income everywhere as the denominator of the fraction. Divide to determine the percentage

of Subject Net Income to apportion to City of Portland. Round apportionment percentages to six places (xx.xxxx% or .xxxxxx).

20. Net Operating Losses (as previously reported on line 19 of prior combined returns) are allowed a maximum carryforward of five (5)

years. The annual deduction cannot exceed 75% of the apportioned income for the current year.

23. Enter all prepayments (quarterly, extension payments, credit carried forward from prior years).

24. Enter all late and/or underpayment penalties that apply (see penalty calculation instructions above).

25. Interest on taxes not paid by the original due date (April 15 for calendar year taxpayers) is calculated at 10% per annum (.00833 x no. of

months). Calculate interest from original due date to the 15th day of the month following the date of payment.

26. Total lines 22, 23, 24 and 25 to determine balance due or (overpayment) for the City of Portland Business License Tax.

27. Overpayments may be refunded, credited forward or transferred between programs. You may also apply a portion or all of your overpayment

as a donation to the “Work for Art” program.* Transfers between programs occur as of the postmark date of request.

28. If payment is due, make check payable to City of Portland.

Also include additional Work for Art donations on this line.

*A donation to “Work for Art,” a program of the Regional Arts & Culture Council, may be made by reducing your refund due or by paying an

amount in addition to the combined amount due. Any designated donation is final. Go to for additional information.

(If you choose to pay by check, you authorize the City of Portland, Revenue Bureau to convert your check to an electronic debit. Funds may be withdrawn from your account upon

receipt, and you will not get your check back. Please call with questions, or to permanently opt out.)

ATTACH DETAILED SCHEDULES FOR NOL DEDUCTIONS OR OTHER DEDUCTIONS FROM INCOME

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2