Form Ct-1065 - Connecticut Partnership Income Tax Return - 2000

ADVERTISEMENT

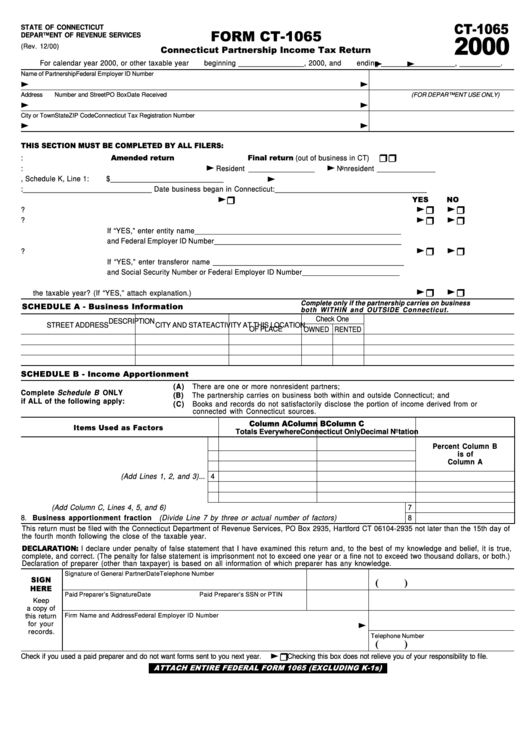

CT-1065

STATE OF CONNECTICUT

FORM CT-1065

2000

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/00)

Connecticut Partnership Income Tax Return

<

<

For calendar year 2000, or other taxable year

beginning ________________, 2000, and

ending __________________, __________.

Name of Partnership

Federal Employer ID Number

<

<

Address

Number and Street

PO Box

Date Received (FOR DEPARTMENT USE ONLY)

<

<

City or Town

State

ZIP Code

Connecticut Tax Registration Number

<

<

THIS SECTION MUST BE COMPLETED BY ALL FILERS:

H

H

Amended return

Final return (out of business in CT)

A. Check here if:

<

<

B. Total number of partners during the taxable year:

Resident _________________

Nonresident _______________

<

C. Enter the amount from federal Form 1065, Schedule K, Line 1:

$ _____________________________

D. Date business began: _________________________________ Date business began in Connecticut: _______________________________________

<

H

YES

NO

E. Check here if any partners are corporate entities

<

<

H

H

F. Does this partnership have an interest in real property located in Connecticut? ......................................................... F.

<

<

H

H

G. Did this partnership transfer a controlling interest in an entity owning Connecticut real property? .......................... G.

If “YES,” enter entity name _____________________________________________________

and Federal Employer ID Number ________________________________________________

<

<

H

H

H. Was a controlling interest in this partnership transferred? .............................................................................................. H.

If “YES,” enter transferor name _________________________________________________

and Social Security Number or Federal Employer ID Number _________________________

I.

Was there a distribution of property from the partnership or a transfer of a partnership interest during

<

<

H

H

the taxable year? (If “YES,” attach explanation.) .............................................................................................................. I.

Complete only if the partnership carries on business

SCHEDULE A - Business Information

both WITHIN and OUTSIDE Connecticut.

Check One

DESCRIPTION

STREET ADDRESS

CITY AND STATE

ACTIVITY AT THIS LOCATION

OF PLACE

OWNED

RENTED

SCHEDULE B - Income Apportionment

(A)

There are one or more nonresident partners;

Complete Schedule B ONLY

(B)

The partnership carries on business both within and outside Connecticut; and

if ALL of the following apply:

(C)

Books and records do not satisfactorily disclose the portion of income derived from or

connected with Connecticut sources.

Column A

Column B

Column C

Items Used as Factors

Totals Everywhere

Connecticut Only

Decimal Notation

1. Real property owned ..................................................... 1

Percent Column B

is of

2. Real property rented from others ................................. 2

Column A

3. Tangible personal property owned or rented ............. 3

4. Property owned or rented (Add Lines 1, 2, and 3) ... 4

5. Employee wages and salaries ..................................... 5

6. Gross income from sales and services ...................... 6

7. Total (Add Column C, Lines 4, 5, and 6) ............................................................................................................................ 7

8. Business apportionment fraction (Divide Line 7 by three or actual number of factors) ................................... 8

This return must be filed with the Connecticut Department of Revenue Services, PO Box 2935, Hartford CT 06104-2935 not later than the 15th day of

the fourth month following the close of the taxable year.

DECLARATION: I declare under penalty of false statement that I have examined this return and, to the best of my knowledge and belief, it is true,

complete, and correct. (The penalty for false statement is imprisonment not to exceed one year or a fine not to exceed two thousand dollars, or both.)

Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of General Partner

Date

Telephone Number

SIGN

(

)

HERE

Paid Preparer’s Signature

Date

Paid Preparer’s SSN or PTIN

Keep

a copy of

Firm Name and Address

Federal Employer ID Number

this return

<

for your

records.

Telephone Number

(

)

<

H

Check if you used a paid preparer and do not want forms sent to you next year.

Checking this box does not relieve you of your responsibility to file.

ATTACH ENTIRE FEDERAL FORM 1065 (EXCLUDING K-1s)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2