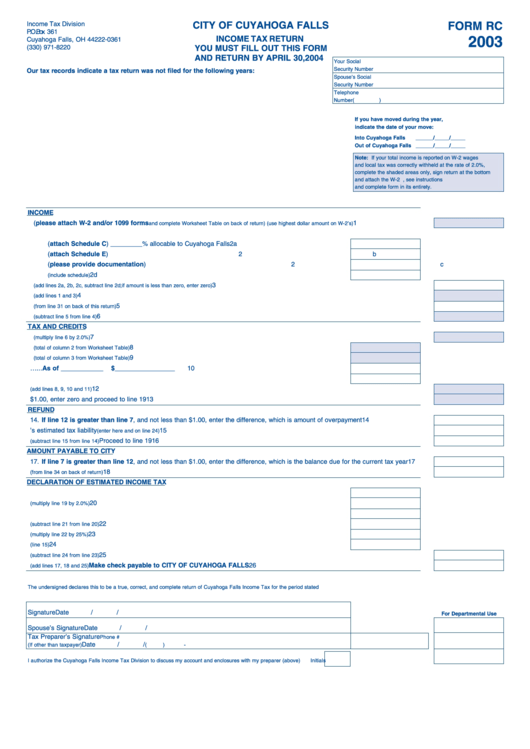

Form Rc - Income Tax Return - City Of Cuyahoga Falls - 2003

ADVERTISEMENT

Income Tax Division

CITY OF CUYAHOGA FALLS

FORM RC

P.O. Box 361

INCOME TAX RETURN

2003

Cuyahoga Falls, OH 44222-0361

(330) 971-8220

YOU MUST FILL OUT THIS FORM

AND RETURN BY APRIL 30, 2004

Your Social

Security Number

Our tax records indicate a tax return was not filed for the following years:

Spouse’s Social

Security Number

Telephone

Number

(

)

If you have moved during the year,

indicate the date of your move:

Into Cuyahoga Falls

______/_____/_____

Out of Cuyahoga Falls ______/_____/_____

Note: If your total income is reported on W-2 wages

and local tax was correctly withheld at the rate of 2.0%,

complete the shaded areas only, sign return at the bottom

and attach the W-2 forms. All others, see instructions

and complete form in its entirety.

INCOME

1. Wages and salaries (please attach W-2 and/or 1099 forms

1

and complete Worksheet Table on back of return) (use highest dollar amount on W-2’s)

2. Other Taxable Income

2a. Business Income (attach Schedule C) _________% allocable to Cuyahoga Falls

2a

2b. Rental or Supplemental Income (attach Schedule E)

2b

2c. Other income (please provide documentation)

2c

2d. Loss carried forward from previous years

2d

(include schedule)

3. Total other taxable income

3

(add lines 2a, 2b, 2c, subtract line 2d; if amount is less than zero, enter zero)

4. Total taxable income before deductions

4

(add lines 1 and 3)

5. Deductions

5

(from line 31 on back of this return)

6. Cuyahoga Falls taxable income

6

(subtract line 5 from line 4)

TAX AND CREDITS

7. Cuyahoga Falls tax due before credits

7

(multiply line 6 by 2.0%)

8. Taxes withheld and paid to Cuyahoga Falls

8

(total of column 2 from Worksheet Table)

9. Taxes withheld and paid to other localities

9

(total of column 3 from Worksheet Table)

10. Estimated tax payments made to Cuyahoga Falls…...As of ____________

$_________________

10

11. Income tax credit carried forward from prior years

11

12. Total credits

12

(add lines 8, 9, 10 and 11)

13. If difference between line 7 and line 12 is less than $1.00, enter zero and proceed to line 19

13

REFUND

14. If line 12 is greater than line 7, and not less than $1.00, enter the difference, which is amount of overpayment

14

15. Amount of line 14 to be credited to next year’s estimated tax liability

15

(enter here and on line 24)

16. Amount to be refunded

Proceed to line 19

16

(subtract line 15 from line 14)

AMOUNT PAYABLE TO CITY

17. If line 7 is greater than line 12, and not less than $1.00, enter the difference, which is the balance due for the current tax year

17

18. Penalty and Interest

18

(from line 34 on back of return)

DECLARATION OF ESTIMATED INCOME TAX

19. Estimated taxable income for tax year

19

20. Estimated tax due

20

(multiply line 19 by 2.0%)

21. Taxes to be withheld and paid to Cuyahoga Falls and other localities

21

22. Balance of estimated tax due

22

(subtract line 21 from line 20)

23. First quarter of estimated tax payable to City

23

(multiply line 22 by 25%)

24. Prior credit applied to estimated tax payments

24

(line 15)

25. Net amount due for initial quarterly payment

25

(subtract line 24 from line 23)

26. Total amount due

Make check payable to CITY OF CUYAHOGA FALLS

26

(add lines 17, 18 and 25)

The undersigned declares this to be a true, correct, and complete return of Cuyahoga Falls Income Tax for the period stated

Signature

Date

/

/

For Departmental Use

Spouse’s Signature

Date

/

/

Tax Preparer’s Signature

Phone #

Date

/

/

(If other than taxpayer)

(

)

-

I authorize the Cuyahoga Falls Income Tax Division to discuss my account and enclosures with my preparer (above)

Initials

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2