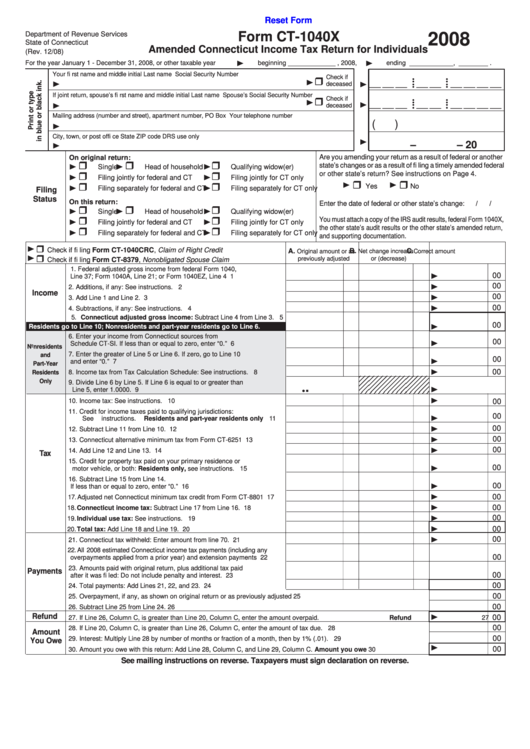

Reset Form

Department of Revenue Services

Form CT-1040X

2008

State of Connecticut

Amended Connecticut Income Tax Return for Individuals

(Rev. 12/08)

For the year January 1 - December 31, 2008, or other taxable year

beginning _____________ , 2008,

ending ____________ , ________ .

Your fi rst name and middle initial

Last name

Social Security Number

Check if

• •

• •

__ __ __ __ __ __ __ __ __

deceased

• •

• •

If joint return, spouse’s fi rst name and middle initial

Last name

Spouse’s Social Security Number

Check if

• •

• •

__ __ __ __ __ __ __ __ __

• •

• •

deceased

Mailing address (number and street), apartment number, PO Box

Your telephone number

(

)

City, town, or post offi ce

State

ZIP code

DRS use only

–

– 20

Are you amending your return as a result of federal or another

On original return:

state’s changes or as a result of fi ling a timely amended federal

Single

Head of household

Qualifying widow(er)

or other state’s return? See instructions on Page 4.

Filing jointly for federal and CT

Filing jointly for CT only

Yes

No

Filing separately for federal and CT

Filing separately for CT only

Filing

Status

On this return:

Enter the date of federal or other state’s change:

/

/

Single

Head of household

Qualifying widow(er)

You must attach a copy of the IRS audit results, federal Form 1040X,

Filing jointly for federal and CT

Filing jointly for CT only

the other state’s audit results or the other state’s amended return,

Filing separately for federal and CT

Filing separately for CT only

and supporting documentation.

Check if fi ling Form CT-1040CRC, Claim of Right Credit

A.

B.

C.

Original amount or as

Net change increase

Correct amount

previously adjusted

or (decrease)

Check if fi ling Form CT-8379, Nonobligated Spouse Claim

1. Federal adjusted gross income from federal Form 1040,

00

Line 37; Form 1040A, Line 21; or Form 1040EZ, Line 4

1

00

2. Additions, if any: See instructions.

2

Income

00

3. Add Line 1 and Line 2.

3

00

4. Subtractions, if any: See instructions.

4

5. Connecticut adjusted gross income: Subtract Line 4 from Line 3.

5

00

Residents go to Line 10; Nonresidents and part-year residents go to Line 6.

....................................................................................................................

6. Enter your income from Connecticut sources from

00

Schedule CT-SI. If less than or equal to zero, enter “0.”

6

Nonresidents

7. Enter the greater of Line 5 or Line 6. If zero, go to Line 10

and

00

and enter “0.”

7

Part-Year

00

Residents

8. Income tax from Tax Calculation Schedule: See instructions.

8

Only

9. Divide Line 6 by Line 5. If Line 6 is equal to or greater than

.

.

Line 5, enter 1.0000.

9

10. Income tax: See instructions.

10

00

11. Credit for income taxes paid to qualifying jurisdictions:

00

See instructions. Residents and part-year residents only

11

00

12. Subtract Line 11 from Line 10.

12

00

13. Connecticut alternative minimum tax from Form CT-6251

13

00

14. Add Line 12 and Line 13.

14

Tax

15. Credit for property tax paid on your primary residence or

00

motor vehicle, or both: Residents only, see instructions.

15

16. Subtract Line 15 from Line 14.

00

If less than or equal to zero, enter “0.”

16

00

17. Adjusted net Connecticut minimum tax credit from Form CT-8801

17

00

18. Connecticut income tax: Subtract Line 17 from Line 16.

18

00

19. Individual use tax: See instructions.

19

00

20. Total tax: Add Line 18 and Line 19.

20

00

21. Connecticut tax withheld: Enter amount from line 70.

21

22. All 2008 estimated Connecticut income tax payments (including any

00

overpayments applied from a prior year) and extension payments

22

23. Amounts paid with original return, plus additional tax paid

Payments

00

after it was fi led: Do not include penalty and interest.

23

00

24. Total payments: Add Lines 21, 22, and 23.

24

00

25. Overpayment, if any, as shown on original return or as previously adjusted

25

00

26. Subtract Line 25 from Line 24.

26

Refund

00

27. If Line 26, Column C, is greater than Line 20, Column C, enter the amount overpaid.

Refund 27

00

28. If Line 20, Column C, is greater than Line 26, Column C, enter the amount of tax due.

28

Amount

00

29. Interest: Multiply Line 28 by number of months or fraction of a month, then by 1% (.01).

29

You Owe

00

30. Amount you owe with this return: Add Line 28, Column C, and Line 29, Column C.

Amount you owe

30

See mailing instructions on reverse. Taxpayers must sign declaration on reverse.

1

1 2

2 3

3