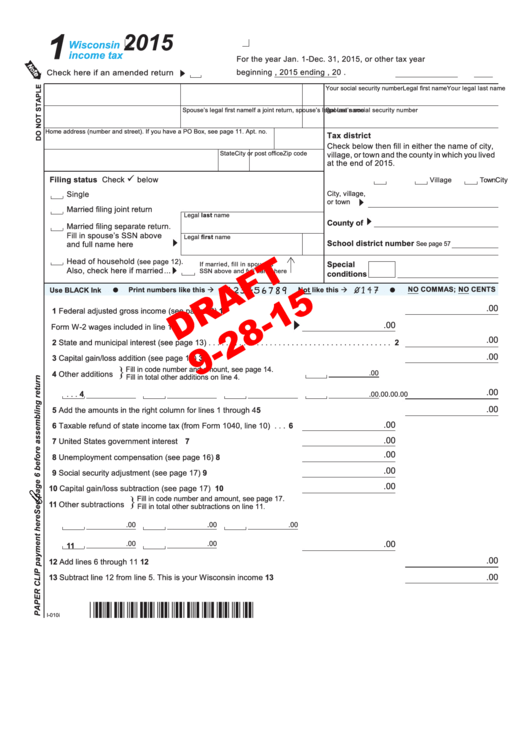

Form 1 Draft - Wisconsin Income Tax - 2015

ADVERTISEMENT

1

2015

Wisconsin

income tax

For the year Jan . 1‑Dec . 31, 2015, or other tax year

Check here if an amended return

beginning

, 2015

ending

, 20

.

Your legal last name

Legal first name

M .I .

Your social security number

If a joint return, spouse’s legal last name

Spouse’s legal first name

M .I .

Spouse’s social security number

Home address (number and street) . If you have a PO Box, see page 11 .

Apt . no .

Tax district

Check below then fill in either the name of city,

City or post office

State

Zip code

village, or town and the county in which you lived

at the end of 2015 .

Filing status Check

below

City

Village

Town

Single

City, village,

or town

Married filing joint return

Legal last name

County of

Married filing separate return.

Fill in spouse’s SSN above

Legal first name

M .I .

School district number

and full name here . . . . . . . . . . . . . . .

See page 57

Head of household

.

(see page 12)

Special

If married, fill in spouse’s

Also, check here if married . . .

SSN above and full name here

conditions

Print numbers like this

Not like this

NO COMMAS; NO CENTS

Use BLACK Ink

.00

1 Federal adjusted gross income (see page 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

Form W‑2 wages included in line 1 . . . . . . . . . . . . . . . . . . . . . . .

.00

2 State and municipal interest (see page 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

3 Capital gain/loss addition (see page 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

}

Fill in code number and amount, see page 14 .

4 Other additions

.00

Fill in total other additions on line 4

.

.00

. . . 4

.00

.00

.00

.00

.00

5 Add the amounts in the right column for lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6 Taxable refund of state income tax (from Form 1040, line 10) . . .

6

.00

7 United States government interest . . . . . . . . . . . . . . . . . . . . . . . .

7

.00

8 Unemployment compensation (see page 16) . . . . . . . . . . . . . . . .

8

.00

9 Social security adjustment (see page 17) . . . . . . . . . . . . . . . . . . .

9

.00

10 Capital gain/loss subtraction (see page 17) . . . . . . . . . . . . . . . . . 10

}

Fill in code number and amount, see page 17 .

11 Other subtractions

Fill in total other subtractions on line 11

.

.00

.00

.00

.00

.00

.00

. . . . . . . . . . . . . . . . 11

.00

12 Add lines 6 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.00

13 Subtract line 12 from line 5 . This is your Wisconsin income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

I‑010i

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4