Net Profits License Fee Return Form - Ohio County Kentucky

ADVERTISEMENT

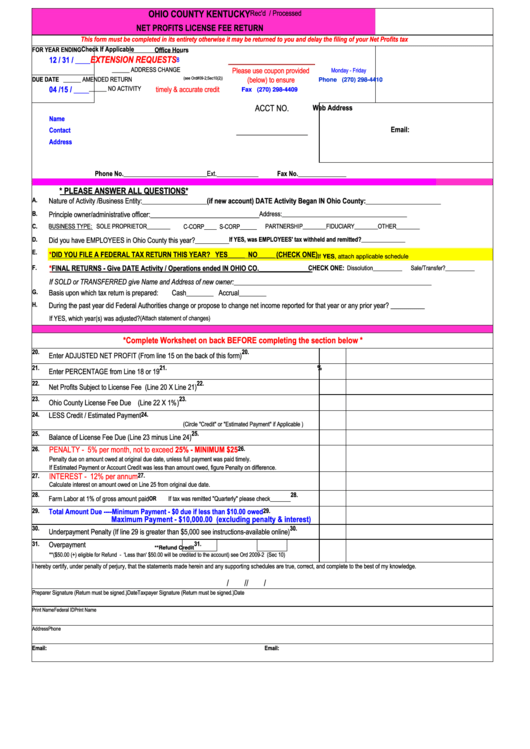

OHIO COUNTY KENTUCKY

Rec'd / Processed

NET PROFITS LICENSE FEE RETURN

This form must be completed in its entirety otherwise it may be returned to you and delay the filing of your Net Profits tax

Check If Applicable

FOR YEAR ENDING

Office Hours

EXTENSION REQUESTS

12 / 31 / ____

8 a.m. - 4 p.m. CT

______ ADDRESS CHANGE

Please use coupon provided

Monday - Friday

DUE DATE

______ AMENDED RETURN

(see Ord#09-2;Sec10(2))

(below) to ensure

Phone (270) 298-4410

04 /15 / ____

______ NO ACTIVITY

timely & accurate credit

Fax (270) 298-4409

ACCT NO.

Web Address

ohiocounty.ky.gov/departments/octax.htm

Name

Email:

Contact

_______________

octaxclerk@ohiocountyky.gov

Address

octaxadmin@ohiocountyky.gov

Phone No.__________________________

Ext._____________

Fax No._______________

* PLEASE ANSWER ALL QUESTIONS*

A.

Nature of Activity /Business Entity:___________________

(if new account) DATE Activity Began IN Ohio County:______________________

B.

Principle owner/administrative officer:________________________________

Address:_______________________________________

C.

BUSINESS TYPE:

SOLE PROPRIETOR________

C-CORP________

S-CORP________ PARTNERSHIP________

FIDUCIARY________ OTHER________

D.

Did you have EMPLOYEES in Ohio County this year?__________

If YES, was EMPLOYEES' tax withheld and remitted?_______________

E.

*DID YOU FILE A FEDERAL TAX RETURN THIS YEAR? YES_____ NO_____ (CHECK ONE)

If YES, attach applicable schedule

F.

*FINAL RETURNS - Give DATE Activity / Operations ended IN OHIO CO._______________

CHECK ONE:

Dissolution________________

Sale/Transfer?__________

If SOLD or TRANSFERRED give Name and Address of new owner:__________________________________________________________

G.

Basis upon which tax return is prepared:

Cash________ Accrual________

H.

During the past year did Federal Authorities change or propose to change net income reported for that year or any prior year? __________

If YES, which year(s) was adjusted?

(Attach statement of changes)

*Complete Worksheet on back BEFORE completing the section below *

20.

20.

Enter ADJUSTED NET PROFIT (From line 15 on the back of this form)

21.

21.

%

Enter PERCENTAGE from Line 18 or 19

22.

22.

Net Profits Subject to License Fee (Line 20 X Line 21)

23.

23.

Ohio County License Fee Due (Line 22 X 1%)

24.

LESS Credit / Estimated Payment

24.

(Circle "Credit" or "Estimated Payment" if Applicable )

25.

25.

Balance of License Fee Due (Line 23 minus Line 24)

26.

26.

PENALTY - 5% per month, not to exceed 25% - MINIMUM $25

Penalty due on amount owed at original due date, unless full payment was paid timely.

If Estimated Payment or Account Credit was less than amount owed, figure Penalty on difference.

27.

27.

INTEREST - 12% per annum

Calculate interest on amount owed on Line 25 from original due date.

28.

28.

Farm Labor at 1% of gross amount paid

OR

If tax was remitted "Quarterly" please check_______

29.

Total Amount Due ----Minimum Payment - $0 due if less than $10.00 owed

29.

Maximum Payment - $10,000.00 (excluding penalty & interest)

30.

30.

Underpayment Penalty (If line 29 is greater than $5,000 see instructions-available online)

31.

Overpayment

31.

**Refund

Credit

**($50.00 (+) eligible for Refund - 'Less than' $50.00 will be credited to the account) see Ord 2009-2 (Sec 10)

I hereby certify, under penalty of perjury, that the statements made herein and any supporting schedules are true, correct, and complete to the best of my knowledge.

/

/

/

/

Preparer Signature (Return must be signed.)

Date

Taxpayer Signature (Return must be signed.)

Date

Print Name

Federal ID

Print Name

Address

Phone No.

Title

Social Security No.

Email:

Email:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3