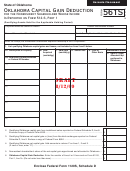

Form 561s Draft - Oklahoma Capital Gain Deduction For The Nonresident Shareholder - 2009 Page 3

ADVERTISEMENT

Form 561S - Page 3

Oklahoma Capital Gain Deduction for the Nonresident Shareholder

Whose Income is reported on Form 512-S, Part 1

Title 68 O.S. Section 2358 and Rule 710:50-15-48

Specific Instructions - continued

Line 5 Note: If less than 100% of a capital gain or loss has been apportioned to Oklahoma, include only such

portion in Column F. For example: on Form 512-S, Part 4, an S corporation apportions 43% of the capital gain/loss

to Oklahoma (based on the apportionment formula). Include 43% of the gain/loss attributable to the nonresident

shareholder whose income is reported on Form 512-S, Part 1, and who has met the holding period. However,

if 100% of the gain/loss was allocated to Oklahoma; then include 100% of the gain/loss attributable to such

nonresident shareholder.

Line 1: List the nonresident shareholder’s share of the qualifying Oklahoma capital gains and losses from the

Federal Schedule D, line 7. In Column A, line A1 enter the description of the property as shown in Federal Column

A and on line A2, enter either the Oklahoma location/address of the real or tangible personal property sold or the

Federal Identification Number of the company, limited liability company or partnership whose stock or ownership

interest was sold. Complete Columns B through E using the information from the corresponding columns of the

Federal Schedule D. In Column F enter the nonresident shareholder’s share of the qualifying Oklahoma capital gain

or loss allocated or apportioned to Oklahoma. Do not include gains and losses reported on Form 561S lines 2 and 3.

Line 2: If Federal Form 6252 was used to report the installment method for gain on the sale of eligible property on

the Federal return, compute the capital gain deduction using the nonresident shareholder’s share of the current

year’s taxable portion of the installment payment allocated or apportioned to Oklahoma. Enclose Federal Form

6252. The capital gain from an installment sale is eligible for the Oklahoma capital gain deduction provided the

Draft

property was held by the S corporation for the appropriate holding period as of the date sold. The nonresident

shareholder must also have been a shareholder in the S corporation for the appropriate holding period as of the

date sold.

8/12/09

Line 3: Enter the nonresident shareholder’s share of the qualifying Oklahoma net capital gain or loss reported on

Federal Schedule D, line 9 which was allocated or apportioned to Oklahoma. Enclose a copy of the Federal Form

8824.

Line 5: For the nonresident shareholder whose income is reported on Form 512-S, Part 1, enter their share of the

net capital gain apportioned and allocated to Oklahoma. The term “net capital gain” means the excess of the net

long-term capital gain for the taxable year over the net short-term capital loss for such year. If there is a net capital

loss, enter zero.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3