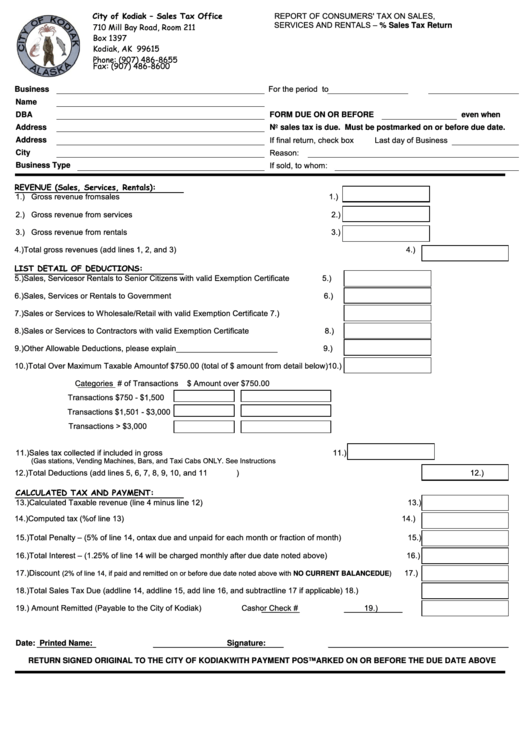

City of Kodiak – Sales Tax Office

REPORT OF CONSUMERS' TAX ON SALES,

SERVICES AND RENTALS – % Sales Tax Return

710 Mill Bay Road, Room 211

Box 1397

Kodiak, AK 99615

Phone: (907) 486-8655

Fax: (907) 486-8600

For the period

to

Business

Name

DBA

FORM DUE ON OR BEFORE

even when

Address

No sales tax is due. Must be postmarked on or before due date.

If final return, check box

Last day of Business

Address

Reason:

City

If sold, to whom:

Business Type

REVENUE (Sales, Services, Rentals):

1.) Gross revenue from sales

1.)

2.) Gross revenue from services

2.)

3.) Gross revenue from rentals

3.)

4.) Total gross revenues (add lines 1, 2, and 3)

4.)

LIST DETAIL OF DEDUCTIONS:

5.) Sales, Services or Rentals to Senior Citizens with valid Exemption Certificate

5.)

6.) Sales, Services or Rentals to Government

6.)

7.) Sales or Services to Wholesale/Retail with valid Exemption Certificate

7.)

8.) Sales or Services to Contractors with valid Exemption Certificate

8.)

9.) Other Allowable Deductions, please explain _______________________

9.)

10.) Total Over Maximum Taxable Amount of $750.00 (total of $ amount from detail below)10.)

Categories

# of Transactions

$ Amount over $750.00

Transactions $750 - $1,500

Transactions $1,501 - $3,000

Transactions > $3,000

11.) Sales tax collected if included in gross

11.)

(Gas stations, Vending Machines, Bars, and Taxi Cabs ONLY. See Instructions)

12.) Total Deductions (add lines 5, 6, 7, 8, 9, 10, and 11)

12.)

CALCULATED TAX AND PAYMENT:

13.) Calculated Taxable revenue (line 4 minus line 12)

13.)

14.) Computed tax ( % of line 13)

14.)

15.) Total Penalty – (5% of line 14, on tax due and unpaid for each month or fraction of month)

15.)

16.) Total Interest – (1.25% of line 14 will be charged monthly after due date noted above)

16.)

17.) Discount

17.)

(2% of line 14, if paid and remitted on or before due date noted above with NO CURRENT BALANCE DUE)

18.) Total Sales Tax Due (add line 14, add line 15, add line 16, and subtract line 17 if applicable)

18.)

19.) Amount Remitted (Payable to the City of Kodiak)

Cash

or Check #

19.)

Date:

Printed Name:

Signature:

RETURN SIGNED ORIGINAL TO THE CITY OF KODIAK WITH PAYMENT POSTMARKED ON OR BEFORE THE DUE DATE ABOVE

1

1