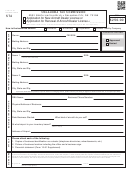

Item number 10 must be completed by out-of-state businesses.

10. Give name, title and address of agent in New Jersey or registered New Jersey agent on whom service may be made (must be documented by letter

from agent) _____________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

11. Is applicant a licensed distributor, importer or exporter in another state or foreign country? Please indicate state, license number, and point of

contact in each state (include name and telephone number). Additionally, please attach a copy of each license. If applicant is a foreign importer,

include copy of US Customs permit. _________________________________________________________________________________________

_______________________________________________________________________________________________________________________

12. Does applicant hold a Federal Form 637? Is so, identify the issuing IRS District Office, provide copy of 637 certificate and copies of applicant’s

last two quarterly Form720 reports filed with the IRS. ___________________________________________________________________________

13. Does applicant hold any other New Jersey Motor Fuel License? If yes, explain _______________________________________________________

_______________________________________________________________________________________________________________________

14. Has applicant ever had a Motor Fuel License denied, suspended, cancelled or revoked in New Jersey or any other jurisdiction? If yes, explain

_______________________________________________________________________________________________________________________

15. Does applicant have any outstanding liability or litigation? If yes, explain ___________________________________________________________

_______________________________________________________________________________________________________________________

16. Indicate below the maximum number of gallons of motor fuels that you expect to import into this state and the maximum number of gallons of

motor fuel you expect to purchase within this state in any month.

IMPORTS _______________ Gal.

NJ PURCHASES _________________Gal.

TOTAL HANDLE __________________ Gal.

NOTE: An “exchange” or “book transfer” of gasoline in this State is a purchase and/or sale and must be reported by seller and purchaser.

Reference: N.J.S.A. 54:39-7.

17. Types of motor fuel to be handled and percentage of each.

__________________________ ______%

__________________________ ______%

__________________________ ______%

18. Describe in detail applicant’s planned activity and need for this license. _____________________________________________________________

_______________________________________________________________________________________________________________________

19. Indicate below by which type of carrier you expect to receive/import motor fuels into this State.

! Tanker

! Pipeline (provide copy of agreement)

! Barge

! Tank Car

! Tank Truck

20. List below each manufacturing, “M” for manufacturing, “W” for wholesale, “R” for retail and “L” for leased.

(If more space is needed, attach rider)

Class

Number

Total Capacity

Location

M, W, R, L

of Tank

Gallons

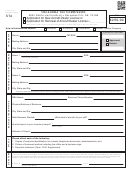

21. Qualification fro an Exporter License may be predicated upon applicant meeting the test of an Exporter. An Exporter License is required by any

person who acquires title or takes delivery of gasoline within New Jersey and subsequently exports such gasoline from the State.

! YES

! NO

a. Will applicant’s exports qualify as defined above? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

! YES

! NO

22. Is applicant registered for Petroleum Products Gross Receipts as required by the Act? . . . . . . . . . . . . . . . .

23. The undersigned applicant states, (under penalty of perjury), that all the information contained in this application is true and accurate in every

particular.

________________________________________________________

_________________________________________________________

Name of Applicant

Signature of Owner, Partner or Officer

_________________________________________________________

Title

Date

All information must be provided before the application can be processed.

The information submitted will assist this office in the processing of your request.

The Division of Taxation reserves the right to conduct a thorough investigation prior to renewing this license.

Return completed application and $450 fee to: MOTOR FUEL TAX, PO Box 189, Trenton, NJ 08695-0189

FOR DIVISION USE ONLY

License No. ______________________________________________

Investigation Initiated ____________________________________________

Effective Date_____________________________________________

Investigation Completed __________________________________________

Approved ________________________________________________

Recommendations: ___________________________________________________________________________________________________________

MFT-3R

1

1 2

2