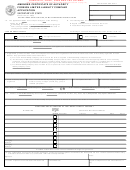

WORKSHEET FOR DETERMINING CAPITAL REPRESENTED IN WISCONSIN

(Supplemental Form 21S)

Compute the proportion of capital represented in Wisconsin during the year cited in item 2, on

page 5, using either a calendar or fiscal year basis. (NOTE: Start by completing items A(1) thru A(7).

Continue, and in sequence, first complete item B and next item C, as each or both may be necessary,

and post the results to item A and complete the computations in item A. Corporations having both Par

Value and No Par Value shares issued will utilize both item B and item C.

A.(1) Gross Business

$_____________

(2) Plus Total Assets

$_____________

(3) Total of lines (1) and (2)

$_____________

(4) Wisconsin business

$_____________

(5) Plus Wisconsin Assets

$_____________

(6) Total of lines (4) and (5)

$_____________

(7) Divide line (6) by line (3) and

enter percentage

___________%

(8) Value of Issued Shares of PAR VALUE

stock from item B (3)

$_____________

(9) Value of Issued Shares of NO PAR

VALUE stock from line C (7)

$_____________

(10) Total of lines (8) and (9)

$_____________

(11) Multiply line (10) by line (7) and enter the product

here and in item 2 on page 5 of this form

$ _____________

B. PAR VALUE STOCK (Use this section to compute valuation of Par Value stock only)

(1) Value of issued shares of Par Value stock,

computed at PAR

$_____________

(2) Paid-in capital, in excess of Par, applicable

to issued shares of Par Value stock

$_____________

(3) Total of lines (1) and (2). Also enter

$_____________

this sum on line A (8) above

C. NO PAR VALUE STOCK (Use this section to compute valuation of No Par Value stock only)

(1) Total assets (From item A.(2) above.)

$_____________

(2) Deduct liabilities other than capital and

Surplus

$_____________

(3) Total of line (1) minus line (2)

$_____________

(4) Deduct amount of line A (8) above

$_____________

(5) Remainder of line (3) minus line (4)

$_____________

(6) Compute value of issued shares of NO PAR

VALUE stock at $10.00 per share

$_____________

(7) Enter the GREATER of line (5) or line (6) here. Also

$_____________

enter this sum on line A (9) above.

21S

DFI/CORP

(R11/12)

6

1

1 2

2