Net Profits License Fee Return Form - City Of Dawson Springs, Ky

ADVERTISEMENT

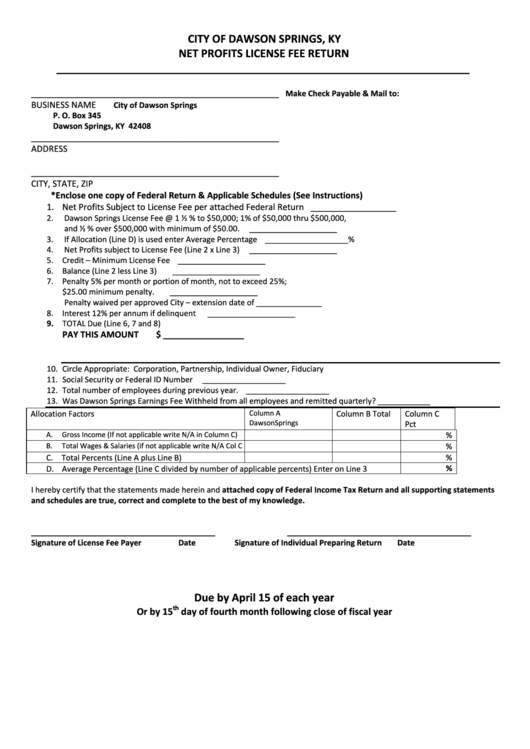

CITY OF DAWSON SPRINGS, KY

NET PROFITS LICENSE FEE RETURN

_____________________________________________________________________

____________________________________________________

Make Check Payable & Mail to:

BUSINESS NAME

City of Dawson Springs

P. O. Box 345

Dawson Springs, KY 42408

____________________________________________________

ADDRESS

____________________________________________________

CITY, STATE, ZIP

*Enclose one copy of Federal Return & Applicable Schedules (See Instructions)

1. Net Profits Subject to License Fee per attached Federal Return

__________________

2.

Dawson Springs License Fee @ 1 ½ % to $50,000; 1% of $50,000 thru $500,000,

and ½ % over $500,000 with minimum of $50.00.

____________________

3.

If Allocation (Line D) is used enter Average Percentage

___________________%

4.

Net Profits subject to License Fee (Line 2 x Line 3)

____________________

5. Credit – Minimum License Fee

____________________

6. Balance (Line 2 less Line 3)

____________________

7. Penalty 5% per month or portion of month, not to exceed 25%;

$25.00 minimum penalty.

____________________

Penalty waived per approved City – extension date of _______________

8. Interest 12% per annum if delinquent

____________________

9. TOTAL Due (Line 6, 7 and 8)

PAY THIS AMOUNT

$ _________________

10. Circle Appropriate: Corporation, Partnership, Individual Owner, Fiduciary

11. Social Security or Federal ID Number

___________________

12. Total number of employees during previous year.

___________________

13. Was Dawson Springs Earnings Fee Withheld from all employees and remitted quarterly? ____________

Column A

Allocation Factors

Column B Total

Column C

DawsonSprings

Pct

A.

Gross Income (If not applicable write N/A in Column C)

%

B.

Total Wages & Salaries (if not applicable write N/A Col C

%

C. Total Percents (Line A plus Line B)

%

D. Average Percentage (Line C divided by number of applicable percents) Enter on Line 3

%

I hereby certify that the statements made herein and attached copy of Federal Income Tax Return and all supporting statements

and schedules are true, correct and complete to the best of my knowledge.

__________________________________________

__________________________________________

Signature of License Fee Payer

Date

Signature of Individual Preparing Return

Date

Due by April 15 of each year

th

Or by 15

day of fourth month following close of fiscal year

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1