Form Wv/sdr-2015a - Schedule A - Syrups, And Prepared Soft Drinks For Retailers And Wholesalers

ADVERTISEMENT

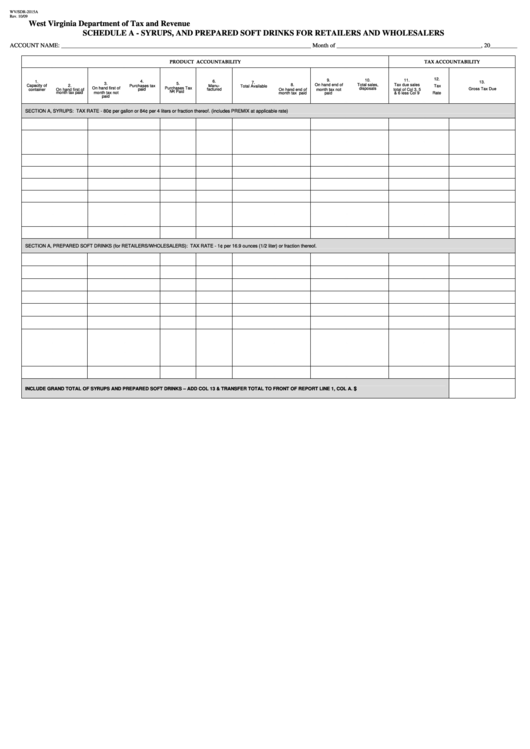

WV/SDR-2015A

Rev. 10/09

West Virginia Department of Tax and Revenue

SCHEDULE A - SYRUPS, AND PREPARED SOFT DRINKS FOR RETAILERS AND WHOLESALERS

ACCOUNT NAME: ___________________________________________________________________________________ Month of ________________________________________________, 20_________

PRODUCT ACCOUNTABILITY

TAX ACCOUNTABILITY

12.

9.

10.

11.

4.

6.

1.

13.

7.

3.

5.

8.

On hand end of

Total sales,

Tax due sales

Capacity of

2.

Purchases tax

Manu-

Tax

Total Available

On hand first of

Purchases Tax

Gross Tax Due

container

On hand first of

On hand end of

month tax not

disposals

total of Col 3, 5

paid

factured

month tax not

Not Paid

Rate

month tax paid

month tax paid

paid

& 6 less Col 9

paid

SECTION A, SYRUPS: TAX RATE - 80¢ per gallon or 84¢ per 4 liters or fraction thereof. (includes PREMIX at applicable rate)

SECTION A, PREPARED SOFT DRINKS (for RETAILERS/WHOLESALERS): TAX RATE - 1¢ per 16.9 ounces (1/2 liter) or fraction thereof.

INCLUDE GRAND TOTAL OF SYRUPS AND PREPARED SOFT DRINKS – ADD COL 13 & TRANSFER TOTAL TO FRONT OF REPORT LINE 1, COL A.

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1