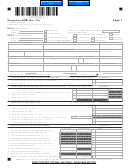

Georgia Form 600 - Corporation Tax Return - 2012/2013 Page 3

ADVERTISEMENT

Page 3

600/2012

Georgia Form

(

C

o

p r

r o

t a

o i

) n

N

a

m

e_______________________________________

FEIN__________________________________________

CLAIMED TAX CREDITS

(ROUND TO NEAREST DOLLAR)

SCHEDULE 9

See pages 16 through 21 for a list of available credits and their applicable codes. You must list the appropriate credit type code in

the space provided. If you claim more than four credits, attach a schedule. Enter the total of the additional schedule on Line 5. If the

tax credit is flowing or being assigned into this corporation from another corporation, please enter the name and FEIN of the

corporation where the tax credit originated. If the credit originated with the corporation filing this return, enter “Same” in the spaces

for corporation and FEIN.

C

e r

d

t i

T

y

p

e

C

o

d

e

C

o

p r

r o

t a

o i

n

N

a

m

e

FEIN

Amount of Credit

SELECT

1.

1.

SELECT

2.

2.

SELECT

3.

3.

SELECT

4.

4.

5. Enter the total from attached schedule(s) ......................................................................................

5.

6. Enter the total of Lines 1 through 5 here and on Schedule 3, Line 3, Page 1 ...............................

6.

ASSIGNED TAX CREDITS

(ROUND TO NEAREST DOLLAR)

SCHEDULE 10

Georgia Code Section 48-7-42 provides that in lieu of claiming any Georgia income tax credit for which a taxpayer otherwise is eligible

for the taxable year, the taxpayer may elect to assign credits in whole or in part to one or more “affiliated entities”. The term “affiliated

entities” is defined as:

1) A corporation that is a member of the taxpayer’s affiliated group within the meaning of Section 1504(a) of the Internal Revenue

Code; or

2) An entity affiliated with a corporation, business, partnership, or limited liability company taxpayer, which entity:

(a) Owns or leases the land on which a project is constructed;

(b) Provides capital for construction of the project; and

(c) Is the grantor or owner under a management agreement with a managing company for the project.

No carryover attributable to the unused portion of any previously claimed or assigned credit may be assigned or reassigned, except if the

assignor and the recipient of an assigned tax credit cease to be affiliated entities, then any carryover attributable to the unused portion

of the credit is transferred back to the assignor of the credit. The assignor is permitted to use any such carryover and also shall be

permitted to assign the carryover to one or more affiliated entities, as if such carryover were an income tax credit for which the assignor

became eligible in the taxable year in which the carryover was transferred back to the assignor. In the case of any credit that must be

claimed in installments in more than one taxable year, the election under this subsection may be made on an annual basis with respect

to each such installment. For additional information, please refer to Georgia Code Section 48-7-42.

If the corporation filing this return is assigning tax credits to other affiliates, please provide detail below specifying where the tax credits

are being assigned.

All assignments of credits must be made before the statutory due date (including extensions) per O.C.G.A. § 48-7-42 (b).

C

e r

d

t i

T

y

p

e

C

o

d

e

C

o

p r

r o

t a

o i

n

N

a

m

e

FEIN

Amount of Credit

SELECT

1.

1.

SELECT

2.

2.

SELECT

3.

3.

SELECT

4.

4.

If this corporation and its affiliates to whom credits are being assigned are filing as part of a Georgia

consolidated return, you must provide the name and FEIN of the corporation under which the consolidated

Georgia return is being filed to ensure that the tax credits are properly applied.

Corporation: ____________________________________________ FEIN __________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4