Print

Reset Form

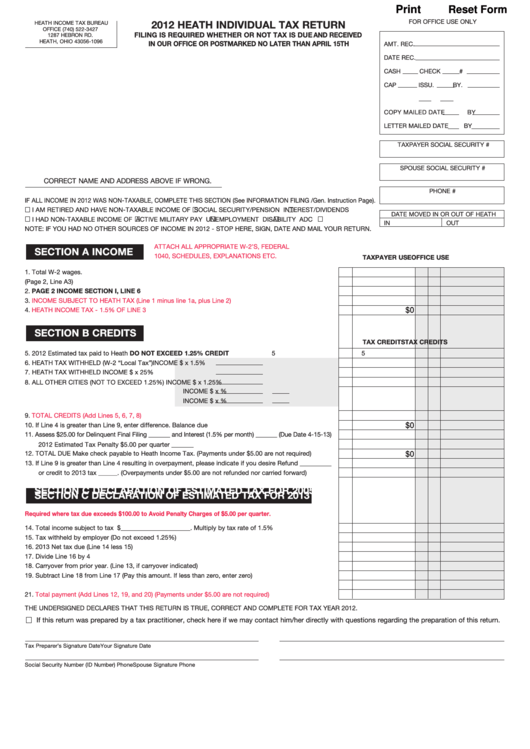

FOR OFFICE USE ONLY

HEATH INCOME TAX BUREAU

2012 HEATH INDIVIDUAL TAX RETURN

OFFICE (740) 522-3427

FILING IS REQUIRED WHETHER OR NOT TAX IS DUE AND RECEIVED

1287 HEBRON RD.

HEATH, OHIO 43056-1096

IN OUR OFFICE OR POSTMARKED NO LATER THAN APRIL 15TH

AMT. REC.

DATE REC.

CASH

CHECK

#

CAP

ISSU.

BY.

AUD.REQ. Y

N

COPY MAILED DATE

BY

LETTER MAILED DATE

BY

TAXPAYER SOCIAL SECURITY #

SPOUSE SOCIAL SECURITY #

CORRECT NAME AND ADDRESS ABOVE IF WRONG.

PHONE #

IF ALL INCOME IN 2012 WAS NON-TAXABLE, COMPLETE THIS SECTION (See INFORMATION FILING /Gen. Instruction Page).

I AM RETIRED AND HAVE NON-TAXABLE INCOME OF

SOCIAL SECURITY/PENSION

INTEREST/DIVIDENDS

DATE MOVED IN OR OUT OF HEATH

I HAD NON-TAXABLE INCOME OF

ACTIVE MILITARY PAY

UNEMPLOYMENT

DISABILITY

ADC

IN

OUT

NOTE: IF YOU HAD NO OTHER SOURCES OF INCOME IN 2012 - STOP HERE, SIGN, DATE AND MAIL YOUR RETURN.

ATTACH ALL APPROPRIATE W-2’S, FEDERAL

SECTION A INCOME

1040, SCHEDULES, EXPLANATIONS ETC.

TAXPAYER USE

OFFICE USE

1.

Total W-2 wages. ..........................................................................................................................................

1

1

1a. Total Adjustments (Page 2, Line A3) ............................................................................................................

1a

1a

2.

PAGE 2 INCOME SECTION I, LINE 6 ........................................................................................................

2

2

3.

INCOME SUBJECT TO HEATH TAX (Line 1 minus line 1a, plus Line 2)

......................................................

3

3

$0

4.

HEATH INCOME TAX - 1.5% OF LINE 3

......................................................................................................

4

4

SECTION B CREDITS

TAX CREDITS

TAX CREDITS

5.

2012 Estimated tax paid to Heath

DO NOT EXCEED 1.25% CREDIT

5

5

6.

HEATH TAX WITHHELD (W-2 “Local Tax”)

INCOME $

x 1.5% ..........................

6

6

7.

HEATH TAX WITHHELD

INCOME $

x 25% ..........................

7

7

8.

ALL OTHER CITIES (NOT TO EXCEED 1.25%)

INCOME $

x 1.25% ........................

8

8

INCOME $

x

% ..................

INCOME $

x

% ..................

9.

TOTAL CREDITS (Add Lines 5, 6, 7,

8)..........................................................................................................

9

9

$0

10. If Line 4 is greater than Line 9, enter difference. Balance due ....................................................................

10

10

11. Assess $25.00 for Delinquent Final Filing _______ and Interest (1.5% per month) _______ (Due Date 4-15-13)

2012 Estimated Tax Penalty $5.00 per quarter _______ ..............................................................................

11

11

$0

12. TOTAL DUE Make check payable to Heath Income Tax. (Payments under $5.00 are not required) ..........

12

12

13. If Line 9 is greater than Line 4 resulting in overpayment, please indicate if you desire Refund __________

or credit to 2013 tax ______. (Overpayments under $5.00 are not refunded nor carried forward) ..............

13

13

SECTION C DECLARATION OF ESTIMATED TAX FOR 2005

SECTION C DECLARATION OF ESTIMATED TAX FOR 2013

Required where tax due exceeds $100.00 to Avoid Penalty Charges of $5.00 per quarter.

14. Total income subject to tax .......... $______________________. Multiply by tax rate of 1.5% ......................

14

14

15. Tax withheld by employer (Do not exceed 1.25%) ......................................................................................

15

15

16. 2013 Net tax due (Line 14 less 15) ..............................................................................................................

16

16

17. Divide Line 16 by 4 ......................................................................................................................................

17

17

18. Carryover from prior year. (Line 13, if carryover indicated) ..........................................................................

18

18

19. Subtract Line 18 from Line 17 (Pay this amount. If less than zero, enter zero) ..........................................

19

19

20. PENALTY ......................................................................................................................................................

20

20

21.

Total payment (Add Lines 12, 19, and 20) (Payments under $5.00 are not required)

..................................

21

21

THE UNDERSIGNED DECLARES THAT THIS RETURN IS TRUE, CORRECT AND COMPLETE FOR TAX YEAR 2012.

If this return was prepared by a tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return.

Tax Preparer’s Signature

Date

Your Signature

Date

Social Security Number (ID Number)

Phone

Spouse Signature

Phone

1

1 2

2