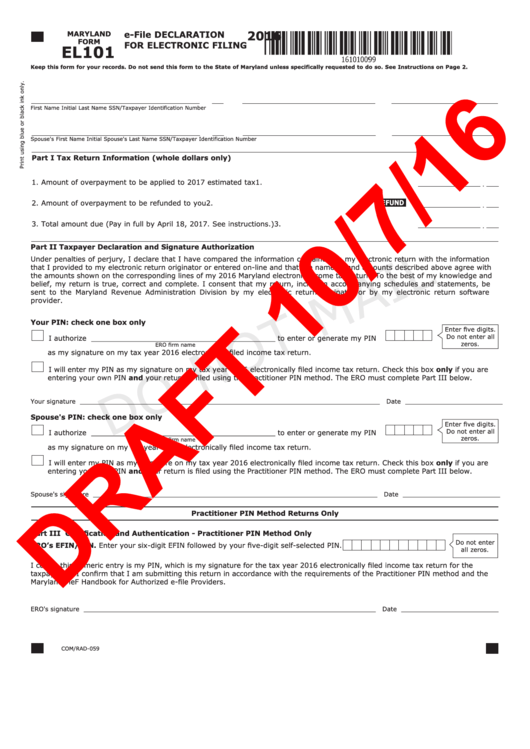

Form El101 - E-File Declaration For Electronic Filing - 2016

ADVERTISEMENT

2016

e-File DECLARATION

MARYLAND

FORM

FOR ELECTRONIC FILING

EL101

Keep this form for your records. Do not send this form to the State of Maryland unless specifically requested to do so. See Instructions on Page 2.

First Name

Initial

Last Name

SSN/Taxpayer Identification Number

Spouse's First Name

Initial

Spouse's Last Name

SSN/Taxpayer Identification Number

Part I

Tax Return Information (whole dollars only)

1. Amount of overpayment to be applied to 2017 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

REFUND

2. Amount of overpayment to be refunded to you . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Total amount due (Pay in full by April 18, 2017. See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

Part II

Taxpayer Declaration and Signature Authorization

Under penalties of perjury, I declare that I have compared the information contained on my electronic return with the information

that I provided to my electronic return originator or entered on-line and that the name(s) and amounts described above agree with

the amounts shown on the corresponding lines of my 2016 Maryland electronic income tax return. To the best of my knowledge and

belief, my return is true, correct and complete. I consent that my return, including accompanying schedules and statements, be

sent to the Maryland Revenue Administration Division by my electronic return originator or by my electronic return software

provider.

Your PIN: check one box only

Enter five digits.

Do not enter all

I authorize __________________________________________ to enter or generate my PIN

zeros.

ERO firm name

as my signature on my tax year 2016 electronically filed income tax return.

I will enter my PIN as my signature on my tax year 2016 electronically filed income tax return. Check this box only if you are

entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Your signature _____________________________________________________________________________ Date _________________________

Spouse's PIN: check one box only

Enter five digits.

Do not enter all

I authorize __________________________________________ to enter or generate my PIN

zeros.

ERO firm name

as my signature on my tax year 2016 electronically filed income tax return.

I will enter my PIN as my signature on my tax year 2016 electronically filed income tax return. Check this box only if you are

entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Spouse's signature _________________________________________________________________________ Date _________________________

Practitioner PIN Method Returns Only

Part III Certification and Authentication - Practitioner PIN Method Only

Do not enter

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

all zeros.

I certify this numeric entry is my PIN, which is my signature for the tax year 2016 electronically filed income tax return for the

taxpayer(s). I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and the

Maryland MeF Handbook for Authorized e-file Providers.

ERO's signature ___________________________________________________________________________ Date _________________________

COM/RAD-059

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2