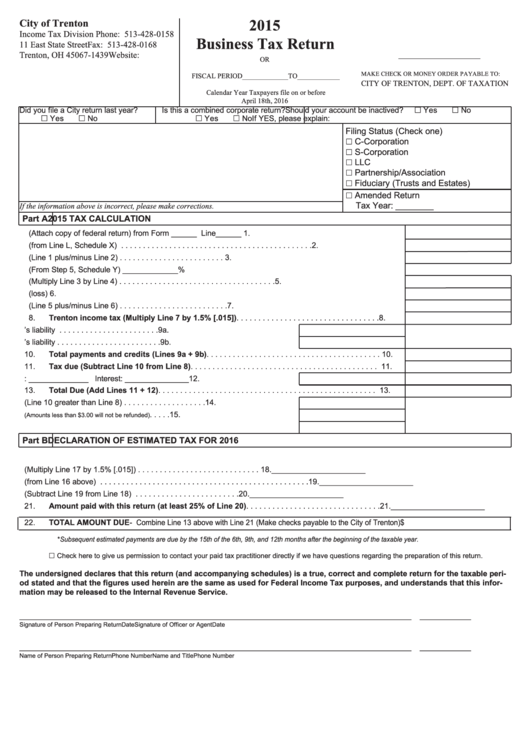

Business Tax Return - City Of Trenton Income Tax Division - 2015

ADVERTISEMENT

2015

City of Trenton

Business Tax Return

Income Tax Division

Phone: 513-428-0158

11 East State Street

Fax: 513-428-0168

Trenton, OH 45067-1439

Website:

OR

MAKE CHECK OR MONEY ORDER PAYABLE TO:

FISCAL PERIOD_____________TO____________

CITY OF TRENTON, DEPT. OF TAXATION

Calendar Year Taxpayers file on or before

April 18th, 2016

Did you file a City return last year?

Is this a combined corporate return?

Should your account be inactived?

Yes

No

Yes

No

Yes

No

If YES, please explain:

Filing Status (Check one)

C-Corporation

S-Corporation

LLC

Partnership/Association

Fiduciary (Trusts and Estates)

Amended Return

Tax Year: ________

If the information above is incorrect, please make corrections.

Part A

2015 TAX CALCULATION

1.

Adjusted Federal Taxable Income (Attach copy of federal return) from Form ______ Line______

1.

2.

Adjustments (from Line L, Schedule X) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

Taxable income before apportionment (Line 1 plus/minus Line 2) . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Apportionment percentage (From Step 5, Schedule Y) _____________%

5.

Trenton taxable income (Multiply Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6.

Other separately stated items. Net operating loss carry forward and Trenton rental income/(loss)

6.

7.

Amount subject to Trenton income tax (Line 5 plus/minus Line 6) . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

Trenton income tax (Multiply Line 7 by 1.5% [.015]) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9a.

Estimates paid on this year’s liability . . . . . . . . . . . . . . . . . . . . . . . 9a.

9b.

Credits applied to this year’s liability . . . . . . . . . . . . . . . . . . . . . . . . 9b.

Total payments and credits (Lines 9a + 9b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

10.

11.

Tax due (Subtract Line 10 from Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12.

Penalty: ______________ Interest: _______________

12.

13.

Total Due (Add Lines 11 + 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14.

Overpayment (Line 10 greater than Line 8) . . . . . . . . . . . . . . . . . . . 14.

15.

Amount to be refunded

. . . . . 15.

(Amounts less than $3.00 will not be refunded)

16.

Credit to next year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

Part B DECLARATION OF ESTIMATED TAX FOR 2016

17.

Total estimated income subject to tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. ______________________

18.

Trenton income tax declared (Multiply Line 17 by 1.5% [.015]) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. ______________________

19.

Less credits (from Line 16 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19. ______________________

20.

Net estimated tax due after credits (Subtract Line 19 from Line 18) . . . . . . . . . . . . . . . . . . . . . . . . 20. ______________________

21.

Amount paid with this return (at least 25% of Line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21. ______________________

22.

TOTAL AMOUNT DUE - Combine Line 13 above with Line 21 (Make checks payable to the City of Trenton) $

*Subsequent estimated payments are due by the 15th of the 6th, 9th, and 12th months after the beginning of the taxable year.

Check here to give us permission to contact your paid tax practitioner directly if we have questions regarding the preparation of this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable peri-

od stated and that the figures used herein are the same as used for Federal Income Tax purposes, and understands that this infor-

mation may be released to the Internal Revenue Service.

_________________________________________

__________

_________________________________________

____________

Signature of Person Preparing Return

Date

Signature of Officer or Agent

Date

_________________________________________

__________

_________________________________________

____________

Name of Person Preparing Return

Phone Number

Name and Title

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4