Form Et-83 - Ohio Beer & Malt Beverage Tax Return Page 2

ADVERTISEMENT

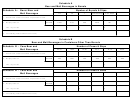

Schedule A

Beer and Malt Beverages in Barrels

Schedule A : Barrel Beer and

Number of Barrels & Sizes

Malt Beverages

1/4

1/2

1

13.2 Gal. Keg

4-5 L Case

1. Sold in Ohio and/or consumed on premises in Ohio

2. Multiply totals on

Tax Rate

1.395

2.79

5.58

2.376

.951

Line 1 by tax rate

$

$

$

$

$

$

3. Tax Liability (Total of amounts on Line 2)

$

Schedule B

Beer and Malt Beverages in Containers Other Than Barrels

Schedule B : Case Beer and

Number of Cases & Sizes

Malt Beverages

24/12

12/32

12/40

24/7

12/12

24/16

1. Sold in Ohio and/or consumed on premises in Ohio

2. Multiply totals on

Tax Rate

.403

.605

.706

.235

.202

.605

Line 1 by tax rate

$

$

$

$

$

$

Schedule B : Case Beer and

Number of Cases & Sizes

Malt Beverages

1. Sold in Ohio and/or consumed on premises in Ohio

2. Multiply totals on

Tax Rate

Line 1 by tax rate

$

$

$

$

$

$

3. Tax Liability (Total of amounts on Line 2)

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2