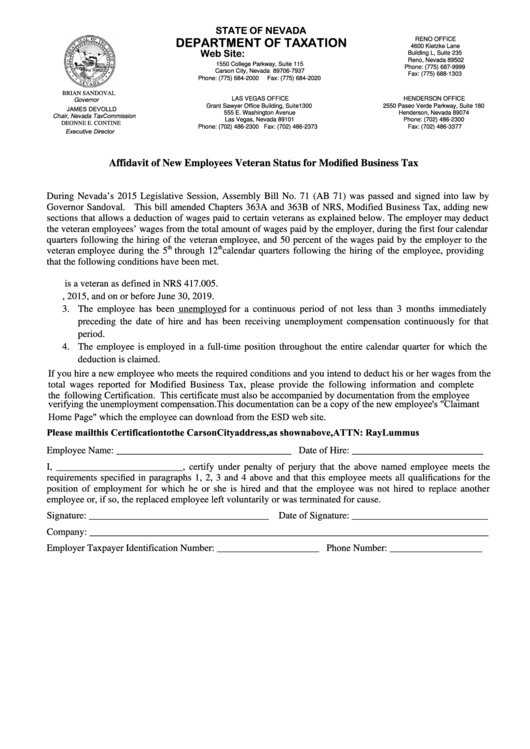

STATE OF NEVADA

DEPARTMENT OF TAXATION

RENO OFFICE

4600 Kietzke Lane

Web Site:

Building L, Suite 235

Reno, Nevada 89502

1550 College Parkway, Suite 115

Phone: (775) 687-9999

Carson City, Nevada 89706-7937

Fax: (775) 688-1303

Phone: (775) 684-2000

Fax: (775) 684-2020

BRIAN SANDOVAL

LAS VEGAS OFFICE

HENDERSON OFFICE

Governor

Grant Sawyer Office Building, Suite1300

2550 Paseo Verde Parkway, Suite 180

JAMES DEVOLLD

555 E. Washington Avenue

Henderson, Nevada 89074

Chair, Nevada Tax Commission

Las Vegas, Nevada 89101

Phone: (702) 486-2300

DEONNE E. CONTINE

Phone: (702) 486-2300

Fax: (702) 486-2373

Fax: (702) 486-3377

Executive Director

Affidavit of New Employees Veteran Status for Modified Business Tax

During Nevada’s 2015 Legislative Session, Assembly Bill No. 71 (AB 71) was passed and signed into law by

Governor Sandoval. This bill amended Chapters 363A and 363B of NRS, Modified Business Tax, adding new

sections that allows a deduction of wages paid to certain veterans as explained below. The employer may deduct

the veteran employees’ wages from the total amount of wages paid by the employer, during the first four calendar

quarters following the hiring of the veteran employee, and 50 percent of the wages paid by the employer to the

th

th

veteran employee during the 5

through 12

calendar quarters following the hiring of the employee, providing

that the following conditions have been met.

1. The employee is a veteran as defined in NRS 417.005.

2. The employee is first hired by the employer on or after July 1, 2015, and on or before June 30, 2019.

3. The employee has been unemployed for a continuous period of not less than 3 months immediately

preceding the date of hire and has been receiving unemployment compensation continuously for that

period.

4. The employee is employed in a full-time position throughout the entire calendar quarter for which the

deduction is claimed.

If you hire a new employee who meets the required conditions and you intend to deduct his or her wages from the

total wages reported for Modified Business Tax, please provide the following information and complete

the following Certification. This certificate must also be accompanied by documentation from the employee

verifying the unemployment compensation. This documentation can be a copy of the new employee's "Claimant

Home Page" which the employee can download from the ESD web site.

Please mail this Certification to the Carson City address, as shown above, ATTN: Ray Lummus

Employee Name: ____________________________________ Date of Hire: ___________________________

I, __________________________, certify under penalty of perjury that the above named employee meets the

requirements specified in paragraphs 1, 2, 3 and 4 above and that this employee meets all qualifications for the

position of employment for which he or she is hired and that the employee was not hired to replace another

employee or, if so, the replaced employee left voluntarily or was terminated for cause.

Signature: _____________________________________ Date of Signature: ____________________________

Company: __________________________________________________________________________________

Employer Taxpayer Identification Number: _____________________ Phone Number: ___________________

1

1