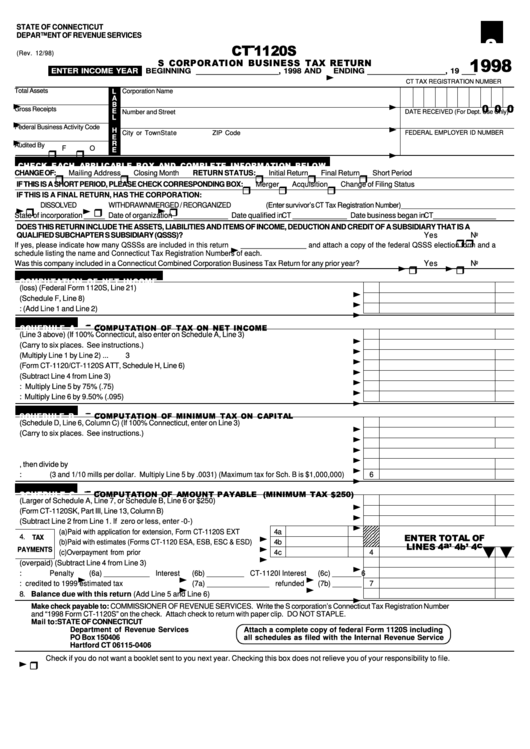

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/98)

ENTER INCOME YEAR

BEGINNING __________________, 1998 AND

ENDING _________________, 19 ___

CT TAX REGISTRATION NUMBER

Total Assets

L

Corporation Name

A

B

Gross Receipts

E

Number and Street

DATE RECEIVED (For Dept. Use Only)

L

Federal Business Activity Code

H

City or Town

State

ZIP Code

FEDERAL EMPLOYER ID NUMBER

E

R

Audited By

F

O

E

CHANGE OF:

Mailing Address

Closing Month

RETURN STATUS:

Initial Return

Final Return

Short Period

IF THIS IS A SHORT PERIOD, PLEASE CHECK CORRESPONDING BOX:

Merger

Acquisition

Change of Filing Status

IF THIS IS A FINAL RETURN, HAS THE CORPORATION:

DISSOLVED

WITHDRAWN

MERGED / REORGANIZED (Enter survivor’s CT Tax Registration Number)____________________________

State of incorporation _____ Date of organization _____________ Date qualified in CT _____________ Date business began in CT_______________

DOES THIS RETURN INCLUDE THE ASSETS, LIABILITIES AND ITEMS OF INCOME, DEDUCTION AND CREDIT OF A SUBSIDIARY THAT IS A

QUALIFIED SUBCHAPTER S SUBSIDIARY (QSSS)? ..................................................................................................

Yes

N o

If yes, please indicate how many QSSSs are included in this return

________________ and attach a copy of the federal QSSS election form and a

schedule listing the name and Connecticut Tax Registration Numbers of each .

Yes

N o

Was this company included in a Connecticut Combined Corporation Business Tax Return for any prior year? .............

1. Federal ordinary income (loss) (Federal Form 1120S, Line 21) ...........................................................

1

2. Unallowable deduction for corporation tax (Schedule F, Line 8) .........................................................

2

3. Net Income: (Add Line 1 and Line 2) ...................................................................................................

3

1. Net Income (Line 3 above) (If 100% Connecticut, also enter on Schedule A, Line 3) ...........................

1

2. Apportionment fraction (Carry to six places. See instructions.) .........................................................

2

0.

3. Connecticut net income (Multiply Line 1 by Line 2) ..............................................................................

3

4. Operating loss carryover (Form CT-1120/CT-1120S ATT, Schedule H, Line 6) ....................................

4

5. Connecticut S corporation net income or loss (Subtract Line 4 from Line 3) ........................................

5

6. Connecticut S corporation net income subject to tax: Multiply Line 5 by 75% (.75) .............................

6

7. TAX: Multiply Line 6 by 9.50% (.095) .................................................................................................

7

1. Minimum tax base (Schedule D, Line 6, Column C) (If 100% Connecticut, enter on Line 3) ...................

1

2. Apportionment fraction (Carry to six places. See instructions.) .........................................................

2

0.

3. Multiply Line 1 by Line 2 .....................................................................................................................

3

4. Number of months covered by this return ..........................................................................................

4

5. Multiply Line 3 by Line 4, then divide by 12 .........................................................................................

5

6. TAX: (3 and 1/10 mills per dollar. Multiply Line 5 by .0031) (Maximum tax for Sch. B is $1,000,000) ....

6

1. Tax (Larger of Schedule A, Line 7, or Schedule B, Line 6 or $250) .....................................................

1

2. Tax Credits (Form CT-1120SK, Part III, Line 13, Column B) ..................................................................

2

3. Balance of tax payable (Subtract Line 2 from Line 1. If zero or less, enter -0-) ..................................

3

1 2 3 4 5 6 7

1 2 3 4 5 6 7

1 2 3 4 5 6 7

(a) Paid with application for extension, Form CT-1120S EXT ......

4a

1 2 3 4 5 6 7

4.

1 2 3 4 5 6 7

TAX

1 2 3 4 5 6 7

(b) Paid with estimates (Forms CT-1120 ESA, ESB, ESC & ESD)

4b

1 2 3 4 5 6 7

1 2 3 4 5 6 7

PAYMENTS

(c) Overpayment from prior year ..................................................

4c

4

5. Balance of tax due (overpaid) (Subtract Line 4 from Line 3) ...............................................................

5

6. Add: Penalty

(6a) ___________ Interest

(6b) _________ CT-1120I Interest

(6c) _______

6

7. Amount to be: credited to 1999 estimated tax

(7a) _______________ refunded

(7b) _______

7

8. Balance due with this return (Add Line 5 and Line 6) ...................................................................

8

Make check payable to: COMMISSIONER OF REVENUE SERVICES. Write the S corporation’s Connecticut Tax Registration Number

and “1998 Form CT-1120S” on the check. Attach check to return with paper clip. DO NOT STAPLE.

Mail to:

STATE OF CONNECTICUT

Department of Revenue Services

Attach a complete copy of federal Form 1120S including

PO Box 150406

all schedules as filed with the Internal Revenue Service

Hartford CT 06115-0406

Check if you do not want a booklet sent to you next year. Checking this box does not relieve you of your responsibility to file.

1

1 2

2