Form 04-611x - Amended Alaska Corporation Net Income Tax Return

ADVERTISEMENT

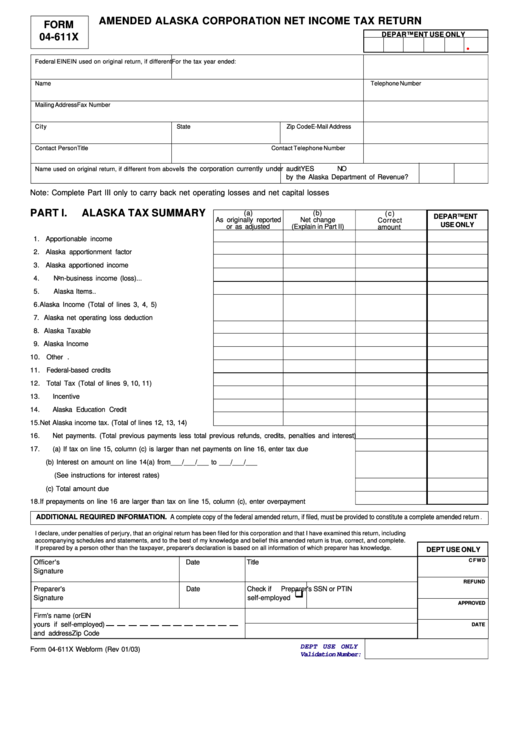

AMENDED ALASKA CORPORATION NET INCOME TAX RETURN

FORM

DEPARTMENT USE ONLY

04-611X

.

Federal EIN

EIN used on original return, if different

For the tax year ended:

Name

Telephone Number

Mailing Address

Fax Number

City

State

Zip Code

E-Mail Address

Contact Person

Title

Contact Telephone Number

Is the corporation currently under audit

YES

NO

Name used on original return, if different from above

by the Alaska Department of Revenue?

Note: Complete Part III only to carry back net operating losses and net capital losses

PART I.

ALASKA TAX SUMMARY

(a)

(b)

( c )

DEPARTMENT

As originally reported

Net change

Correct

USE ONLY

(Explain in Part II)

or as adjusted

amount

1. Apportionable income ...................................................

2. Alaska apportionment factor .........................................

3. Alaska apportioned income ...........................................

4. Non-business income (loss)... ......................................

5. Alaska Items... . ...............................................................

6. Alaska Income (Total of lines 3, 4, 5).........................

7. Alaska net operating loss deduction ...........................

8. Alaska Taxable Income..................................................

9. Alaska Income Tax.........................................................

10. Other Taxes......................................................................

11. F ederal-based credits......................................................

12. Total T ax (Total of lines 9, 10, 11)..................................

13. Incentive Credits............... .............................................

14. Alaska Education Credit.................................................

15. Net Alaska income tax. (Total of lines 12, 13, 14) ........

16. Net payments. (Total previous payments less total previous refunds, credits, penalties and interest)

17. (a) If tax on line 15, column (c) is larger than net payments on line 16, enter tax due ..........................

(b) Interest on amount on line 14(a) from___/___/___ to ___/___/___

(See instructions for interest rates) ....................................................................................................

(c) Total amount due ................................................................................................................................

18. If prepayments on line 16 are larger than tax on line 15, column (c), enter overpayment ....................

ADDITIONAL REQUIRED INFORMATION. A complete copy of the federal amended return, if filed, must be provided to constitute a complete amended return

.

I declare, under penalties of perjury, that an original return has been filed for this corporation and that I have examined this return, including

accompanying schedules and statements, and to the best of my knowledge and belief this amended return is true, correct, and complete.

If prepared by a person other than the taxpayer, preparer's declaration is based on all information of which preparer has knowledge.

DEPT USE ONLY

C F W D

Officer's

Date

Title

Signature

REFUND

Preparer's

Date

Check if

Preparer's SSN or PTIN

q

Signature

self-employed

APPROVED

Firm's name (or

EIN

yours if self-employed)

DATE

and address

Zip Code

DEPT USE ONLY

Form 04-611X Webform (Rev 01/03)

Validation Number:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2