Print

Reset

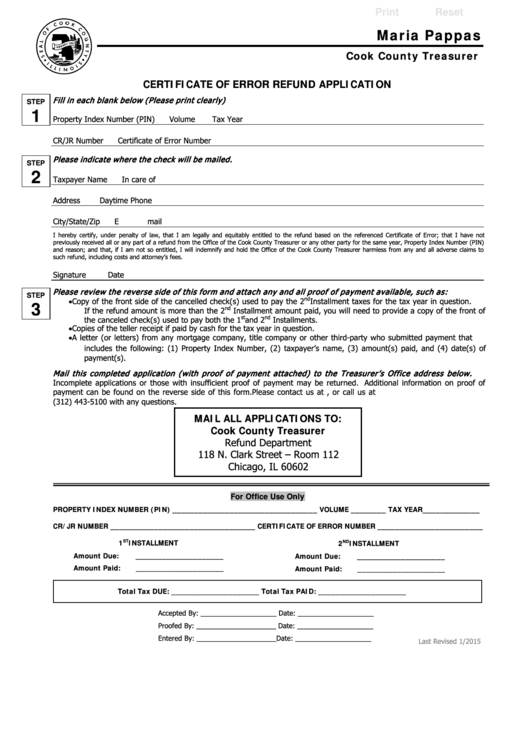

Maria Pappas

Cook County Treasurer

CERTIFICATE OF ERROR REFUND APPLICATION

Fill in each blank below (P lease print clearly)

STEP

1

Property Index Number (PIN)

Volume

Tax Year

CR/JR Number

Certificate of Error Number

P lease indicate w here the check w ill be m ailed.

STEP

2

Taxpayer Name

In care of

Address

Daytime Phone

City/State/Zip

Email

I hereby c ertify, under penalty of law, t hat I a m l egally and equitably entitled to t he refund based on the referenced Certificate of Error; t hat I have not

previously received all or any part of a refund from the Office of the Cook County Treasurer or any other party for the same year, Property Index Number (PIN)

and reason; and that, if I am not so entitled, I will indemnify and hold the Office of the Cook County Treasurer harmless from any and all adverse claims to

such refund, including costs and attorney’s fees.

Signature

Date

P lease review the reverse side of this form and attach any and all proof of paym ent available, such as:

STEP

nd

Copy of the front side of the cancelled check(s) used to pay the 2

Installment taxes for the tax year in question.

•

3

nd

If the refund amount is more than the 2

Installment amount paid, you will need to provide a copy of the front of

st

nd

the canceled check(s) used to pay both the 1

and 2

Installments.

•

Copies of the teller receipt if paid by cash for the tax year in question.

•

A letter (or letters) from any mortgage company, title company or other third-party who submitted payment that

includes the following: (1) Property Index Number, (2) taxpayer’s name, (3) amount(s) paid, and (4) date(s) of

payment(s).

M ail this com pleted application (w ith proof of paym ent attached) to the Treasurer’s Office address below .

Incomplete applications or those with insufficient proof of payment may be returned. Additional information on proof of

payment can be found on the reverse side of this form. Please contact us at , or call us at

(312) 443-5100 with any questions.

MAIL ALL APPLICATIONS TO:

Cook County Treasurer

Refund Department

118 N. Clark Street – Room 112

Chicago, IL 60602

For Office Use Only

PROPERTY INDEX NUMBER (PIN) _________________________________ VOLUME ________ TAX YEAR _____________

CR/JR NUMBER _________________________________ CERTIFICATE OF ERROR NUMBER ________________________

1

ST

INSTALLMENT

2

ND

INSTALLMENT

Amount Due:

____________________

Amount Due:

____________________

Amount Paid:

____________________

Amount Paid:

____________________

Total Tax DUE: ____________________

Total Tax PAID: ____________________

Accepted By: ____________________ Date: ____________________

Proofed By: _____________________

Date: ____________________

Entered By: _____________________

Date: ____________________

Last Revised 1/2015

1

1 2

2