RESET FORM

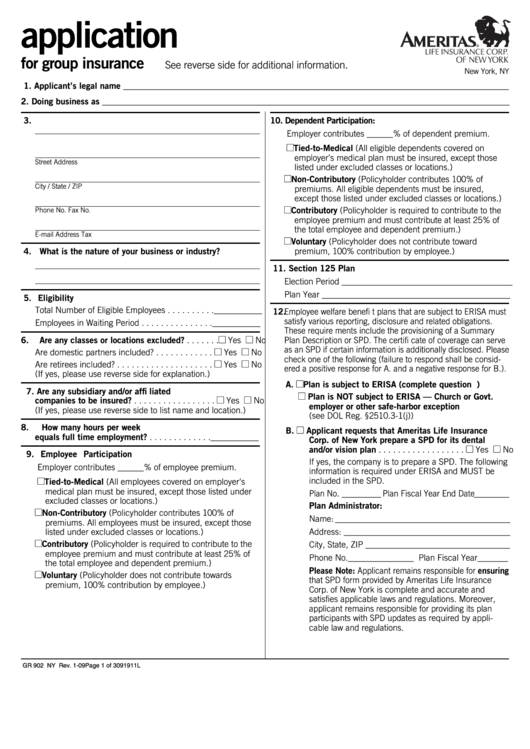

application

for group insurance

See reverse side for additional information.

New York, NY

1. Applicant’s legal name ________________________________________________________________________________________

2. Doing business as _____________________________________________________________________________________________

3.

10. Dependent Participation:

Employer contributes ______% of dependent premium.

P.O. Box / ZIP Code

Tied-to-Medical (All eligible dependents covered on

employer’s medical plan must be insured, except those

Street Address

listed under excluded classes or locations.)

Non-Contributory (Policyholder contributes 100% of

City / State / ZIP

premiums. All eligible dependents must be insured,

except those listed under excluded classes or locations.)

Contributory (Policyholder is required to contribute to the

Phone No.

Fax No.

employee premium and must contribute at least 25% of

the total employee and dependent premium.)

E-mail Address

Tax I.D. No.

Voluntary (Policyholder does not contribute toward

4. What is the nature of your business or industry?

premium, 100% contribution by employee.)

11. Section 125 Plan

Election Period _______________________________________

Plan Year ___________________________________________

5. Eligibility

Total Number of Eligible Employees . . . . . . . . . . ___________

12. Employee welfare benefi t plans that are subject to ERISA must

satisfy various reporting, disclosure and related obligations.

Employees in Waiting Period . . . . . . . . . . . . . . . ___________

These require ments include the provisioning of a Summary

6. Are any classes or locations excluded? . . . . . . .

Yes

No

Plan Description or SPD. The certifi cate of coverage can serve

as an SPD if certain information is additionally disclosed. Please

Are domestic partners included? . . . . . . . . . . . .

Yes

No

check one of the following (failure to respond shall be consid-

Are retirees included? . . . . . . . . . . . . . . . . . . . .

Yes

No

ered a positive response for A. and a negative response for B.).

(If yes, please use reverse side for explanation.)

A.

Plan is subject to ERISA (complete question 12.B.)

7. Are any subsidiary and/or affi liated

Plan is NOT subject to ERISA — Church or Govt.

companies to be insured? . . . . . . . . . . . . . . . . .

Yes

No

employer or other safe-harbor exception

(If yes, please use reverse side to list name and location.)

(see DOL Reg. §2510.3-1(j))

8. How many hours per week

B.

Applicant requests that Ameritas Life Insurance

equals full time employment? . . . . . . . . . . . . . ___________

Corp. of New York prepare a SPD for its dental

and/or vision plan . . . . . . . . . . . . . . . . . .

Yes

No

9. Employee Participation

If yes, the company is to prepare a SPD. The following

Employer contributes ______% of employee premium.

information is required under ERISA and MUST be

included in the SPD.

Tied-to-Medical (All employees covered on employer’s

medical plan must be insured, except those listed under

Plan No. _________ Plan Fiscal Year End Date________

excluded classes or locations.)

Plan Administrator:

Non-Contributory (Policyholder contributes 100% of

Name: ________________________________________

premiums. All employees must be insured, except those

listed under excluded classes or locations.)

Address: ______________________________________

Contributory (Policyholder is required to contribute to the

City, State, ZIP _________________________________

employee premium and must contribute at least 25% of

Phone No._______________ Plan Fiscal Year_______

the total employee and dependent premium.)

Please Note: Applicant remains responsible for ensuring

Voluntary (Policyholder does not contribute towards

that SPD form provided by Ameritas Life Insurance

premium, 100% contribution by employee.)

Corp. of New York is complete and accurate and

satisfies applicable laws and regulations. Moreover,

applicant remains responsible for providing its plan

participants with SPD updates as required by appli-

cable law and regulations.

GR 902 NY Rev. 1-09

Page 1 of 3

091911L

1

1 2

2 3

3