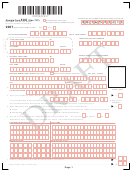

Form Sc1040 Draft - Individual Income Tax Return - 2010 Page 2

ADVERTISEMENT

BARCODE

Page 2 of 3

INCOME AND ADJUSTMENTS

Dollars

1.

Enter federal taxable income from your federal Form 1040, 1040A, or 1040EZ. If zero or less, enter zero here

1.

00

Nonresident filers complete Schedule NR and enter total from line 49 on line 5 below . . . . . . . . . . . . . . . . . . . .

. . . .

ADDITIONS TO FEDERAL TAXABLE INCOME

00

a.

a.

State tax addback, if itemizing on federal return

(See instructions) . . . . . . . . . . . . . .

b.

Out-of-state losses

(See instructions)

00

Check type of loss:

Rental

Business

Other

. . .

b.

00

c.

Expenses related to National Guard and Military Reserve income . . . . . . . . . . . .

c.

d.

Interest income on obligations of states and political subdivisions other

than South Carolina . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

d.

00

e.

Other additions to income. Attach an explanation

e.

(See instructions) . . . . . . . . . . . .

00

2.

Add lines a through e and enter the total here. These are your total additions . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

00

3.

Add lines 1 and 2 and enter the total here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

00

f.

State tax refund, if included on your federal return . . . . . . . . . . . . . . . . . . . . . . .

f.

Dollars

00

g.

Total and permanent disability retirement income, if taxed on your federal return

g.

Out-of-state income/gain – Do not include personal service income

h.

(See instructions)

Check type of income/gain:

Rental

Business

Other

00

h.

00

i.

44% of net capital gains held for more than one year

i.

(See instructions) . . . . . . . .

j.

Volunteer deductions (See instructions) Check type of deduction:

Firefighter

HazMat

Rescue Squad

DNR

Other

Reserve Police

00

j.

Contributions to the SC College Investment Program (“Future Scholar”)

k.

k.

or the SC Tuition Prepayment Program

00

(See instructions) . . . . . . . . . . . . . . . . . . . . .

l.

00

Active Trade or Business Income deduction

l.

(See instructions) . . . . . . . . . . . . . . . . .

00

m.

Interest income from obligations of the US government . . . . . . . . . . . . . . . . . . . . .

m.

00

n.

Certain nontaxable National Guard or Reserve Pay

n.

(See instructions) . . . . . . . . .

00

o.

Social security and/or railroad retirement, if taxed on your federal return . . . . .

o.

p.

Caution: Retirement Deduction

(See instructions)

00

p-1.

Taxpayer: date of birth

. . . . . . . . . . . . . . . . . . . . . . . . .

p-1.

Spouse:

date of birth

. . . . . . . . . . . . . . . . . . . . . . . . .

00

p-2.

p-2.

Surviving spouse #1: date of birth of deceased spouse

. .

00

p-3.

p-3.

00

p-4.

Surviving spouse #2: date of birth of deceased spouse

. .

p-4.

q.

Age 65 and older deduction

(See instructions)

q-1.

Taxpayer: date of birth

. . . . . . . . . . . . . . . . . . . . . . . . .

q-1

00

00

q-2.

Spouse: date of birth

. . . . . . . . . . . . . . . . . . . . . . . . .

q-2

00

r.

Negative amount of federal taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

r.

00

s.

Subsistence allowance

days @ $8.00 . . . . . . . . . . . . . . . . . . . . . . . . . .

s.

00

t.

Dependents under the age of 6 years on December 31 of the tax year . . . . . . .

t.

00

u.

Other subtractions

u.

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

4.

Add lines f through u and enter here. These are your total subtractions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5.

Residents subtract line 4 from line 3 and enter the difference. Nonresidents enter amount from Schedule NR,

line 49. If less than zero, enter zero here . . . . . . . . . .This is your South Carolina INCOME SUBJECT TO TAX

00

5.

00

6.

TAX: enter tax from SOUTH CAROLINA tax tables . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

00

7.

TAX on Lump Sum Distribution

. . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

(Attach SC4972)

00

8.

TAX on Active Trade or Business Income

. . . . . . . . . . . . . . . . . . . . .

8.

(Attach I-335)

00

9.

TAX on excess withdrawals from Catastrophe Savings Accounts . . . . . . . . . . . . .

9.

00

10.

Add lines 6 through 9 and enter the total here . . . . . . . . . . . . . . . . . .This is your TOTAL SOUTH CAROLINA TAX

10.

00

11.

Child and Dependent Care

.

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

00

12.

Two Wage Earner Credit

12.

(See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Other non-refundable credits. Attach SC1040TC and other state return(s) . . . . . .

00

13.

00

14. TOTAL non-refundable credits. Add lines 11 through 13 and enter the total here . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

00

15. SUBTRACT line 14 from line 10. Enter the difference BUT NOT LESS THAN ZERO here . . . . . . . . . . . . . . . . . . . . . 15.

30752026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3