Facility Name___________________________________________

Please enclose payment with fee worksheet & Tier II form.

Make check payable and mail to:

Address ______________________________________________

Kansas Department of Health & Environment

Address ______________________________________________

Right-To-Know Program

1000 SW Jackson, Suite 330

County ________________________

Report Year___________

Topeka KS 66612

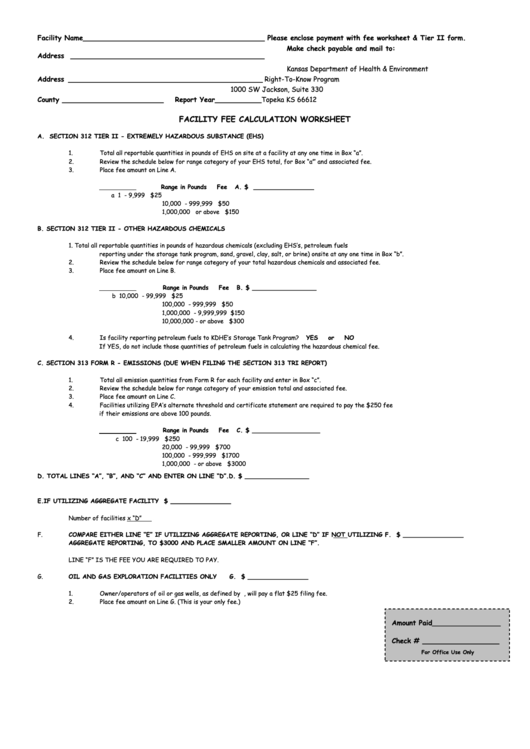

FACILITY FEE CALCULATION WORKSHEET

A.

SECTION 312 TIER II - EXTREMELY HAZARDOUS SUBSTANCE (EHS)

1.

Total all reportable quantities in pounds of EHS on site at a facility at any one time in Box “a”.

2.

Review the schedule below for range category of your EHS total, for Box “a”’ and associated fee.

3.

Place fee amount on Line A.

Range in Pounds

Fee

A. $ ________________

a

1

- 9,999

$25

10,000

- 999,999

$50

1,000,000

or above

$150

B.

SECTION 312 TIER II - OTHER HAZARDOUS CHEMICALS

1.

Total all reportable quantities in pounds of hazardous chemicals (excluding EHS’s, petroleum fuels

reporting under the storage tank program, sand, gravel, clay, salt, or brine) onsite at any one time in Box “b”.

2.

Review the schedule below for range category of your total hazardous chemicals and associated fee.

3.

Place fee amount on Line B.

Range in Pounds

Fee

B. $ _________________

b

10,000

- 99,999

$25

100,000

- 999,999

$50

1,000,000

- 9,999,999

$150

10,000,000

- or above

$300

4.

Is facility reporting petroleum fuels to KDHE’s Storage Tank Program?

YES

or

NO

If YES, do not include those quantities of petroleum fuels in calculating the hazardous chemical fee.

C.

SECTION 313 FORM R - EMISSIONS (DUE WHEN FILING THE SECTION 313 TRI REPORT)

1.

Total all emission quantities from Form R for each facility and enter in Box “c”.

2.

Review the schedule below for range category of your emission total and associated fee.

3.

Place fee amount on Line C.

4.

Facilities utilizing EPA’s alternate threshold and certificate statement are required to pay the $250 fee

if their emissions are above 100 pounds.

Range in Pounds

Fee

C. $ __________________

c

100

- 19,999

$250

20,000

- 99,999

$700

100,000

- 999,999

$1700

1,000,000

- or above

$3000

D.

TOTAL LINES “A”, “B”, AND “C” AND ENTER ON LINE “D”.

D. $ _________________

E.

IF UTILIZING AGGREGATE FACILITY REPORTING.

E. $ ________________

Number of facilities

x “D”

F.

COMPARE EITHER LINE “E” IF UTILIZING AGGREGATE REPORTING, OR LINE “D” IF NOT UTILIZING

F. $ ________________

AGGREGATE REPORTING, TO $3000 AND PLACE SMALLER AMOUNT ON LINE “F”.

LINE “F” IS THE FEE YOU ARE REQUIRED TO PAY.

G.

OIL AND GAS EXPLORATION FACILITIES ONLY

G. $ ________________

1.

Owner/operators of oil or gas wells, as defined by K.S.A. 55-150, will pay a flat $25 filing fee.

2.

Place fee amount on Line G. (This is your only fee.)

Amount Paid________________

Check # __________________

For Office Use Only

1

1