Back to previous page

Back to first page

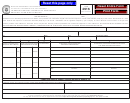

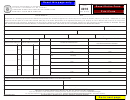

FORM 4916 - LICENSEE’S MONTHLY REPORT OF CIGARETTES AND ROLL-YOUR-OWN TOBACCO REPORTING INSTRUCTIONS

The Missouri Department of Revenue is required by law to compile information about cigarettes and roll-your-own tobacco on which Missouri excise tax is paid.

This information will be provided to the Missouri Attorney General for use in enforcing the law.

THIS REPORT MUST BE FILED, EVEN IF NO ACTIVITY OCCURRED DURING THE REPORTING PERIOD.

Alternate Reports:

You may elect to design your own reports utilizing your own software or database. Alternate forms are permissible with the department’s approval as long as all the required

information is provided and in the same format as the wholesalers monthly report of cigarettes and roll-your-own tobacco.

Heading:

Complete the calendar month and year covered by this report. Business name, address, telephone number, license number, and contact person are required.

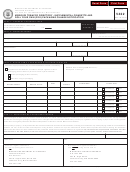

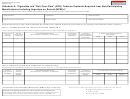

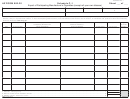

Column A:

Enter the number of individual cigarette (sticks) stamped for sale in Missouri. List only cigarettes contained in packages to which you affixed the Missouri excise tax stamp,

regardless as to whether or not cigarettes were removed from inventory. Do not list cigarettes that were purchased with the Missouri stamp already affixed.

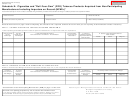

Column B:

Wholesalers report in ounces the quantity of roll-your-own tobacco sold to a retailer in Missouri for each brand listed in Column C. Retailers report in ounces the quantity of

roll-your-own purchased from unlicensed suppliers for sale in Missouri for each brand listed in Column C.

Column C:

Enter the full brand name of the product (do not abbreviate). Do not break down into sub-categories, such as regular, menthol, light, etc., unless they have different manufacturers.

For example, for a cigarette named “Alpha Gold Menthol Lights,” report only “Alpha Gold”. Do not report as “A B Gold” or “A B Gold Menthol Lights”. Copies of invoices for any

non-participating manufacturer brands must be included with this report.

Column D:

List the complete name and address, including street address, city, state, zip code (or equivalent), and country of the physical manufacturer of each brand of cigarettes or

roll-your-own tobacco products from as listed in Column A or B.

Column E:

List the complete name and address, including street, city, and state of the supplier you purchased cigarettes or roll-your-own tobacco products from as listed in Column A or B.

Please ensure that you sign, indicate your title, and date the report.

Mail report to: Missouri Department of Revenue, P.O. Box 811, Jefferson City, MO 65105-0811

If you have questions or need assistance in completing this form, please call (573) 751-7163 during the hours of 7:30 a.m. and 5:30 p.m. Monday through Friday or email

excise@dor.mo.gov.

You may also obtain this form from the department’s web site at: TDD (800) 735-2966

MO 860-2969 (05-2008)

1

1 2

2 3

3