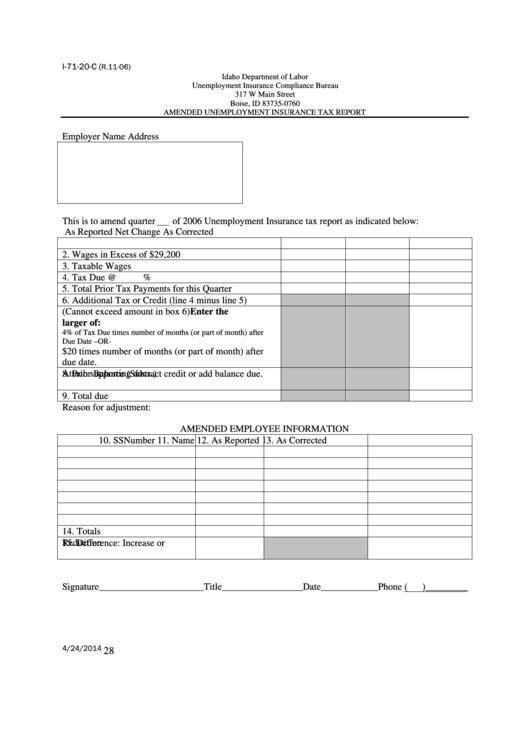

Form I-71-20-C - Amended Unemployment Insurance Tax Report

ADVERTISEMENT

I-71-20-C (

R.11-06)

Idaho Department of Labor

Unemployment Insurance Compliance Bureau

317 W Main Street

Boise, ID 83735-0760

AMENDED UNEMPLOYMENT INSURANCE TAX REPORT

Employer Name Address

This is to amend quarter

of 2006 Unemployment Insurance tax report as indicated below:

As Reported

Net Change

As Corrected

1.Total Gross Wages Paid this Quarter

2. Wages in Excess of $29,200

3. Taxable Wages

4. Tax Due @

%

5. Total Prior Tax Payments for this Quarter

6. Additional Tax or Credit (line 4 minus line 5)

7.Penalty (Cannot exceed amount in box 6) Enter the

larger of:

4% of Tax Due times number of months (or part of month) after

Due Date –OR-

$20 times number of months (or part of month) after

due date.

8. Prior Balance (Subtract credit or add balance due.

Attach supporting docs.)

9. Total due

Reason for adjustment:

AMENDED EMPLOYEE INFORMATION

10. SSNumber

11. Name

12. As Reported

13. As Corrected

14. Totals

15. Difference: Increase or

Reduction

Signature______________________Title_________________Date____________Phone (

)_________

4/24/2014

28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1