B

u

s

i

n

e

s

s

D

e

v

e

l

o

p

m

e

n

t

C

o

r

p

o

r

a

t

i

o

n

o

f

S

o

u

t

h

C

a

r

o

l

i

n

a

B

u

s

i

n

e

s

s

D

e

v

e

l

o

p

m

e

n

t

C

o

r

p

o

r

a

t

i

o

n

o

f

S

o

u

t

h

C

a

r

o

l

i

n

a

C

h

e

c

k

l

i

s

t

f

o

r

B

D

C

/

S

B

A

7

(

a

)

L

o

a

n

C

h

e

c

k

l

i

s

t

f

o

r

B

D

C

/

S

B

A

7

(

a

)

L

o

a

n

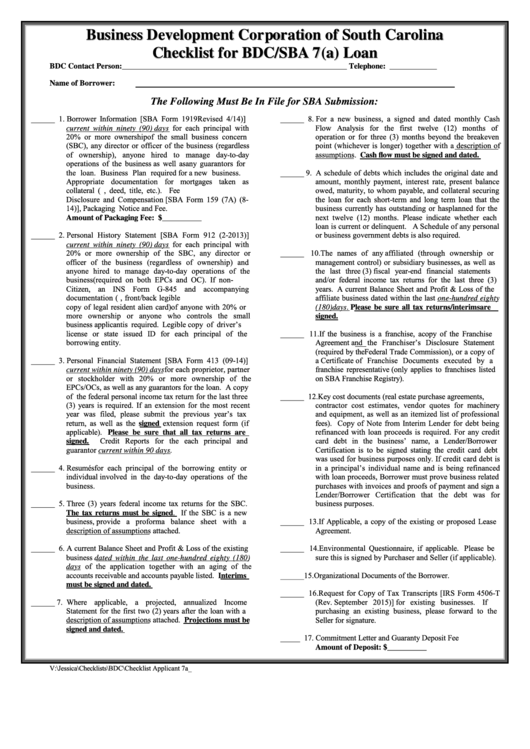

BDC Contact Person:

_________________________________________________________ Telephone: ____________

Name of Borrower:

The Following Must Be In File for SBA Submission:

______ 1. Borrower Information [SBA Form 1919 Revised 4/14)]

______ 8. For a new business, a signed and dated monthly Cash

current within ninety (90) days for each principal with

Flow Analysis for the first twelve (12) months of

20% or more ownership of the small business concern

operation or for three (3) months beyond the breakeven

(SBC), any director or officer of the business (regardless

point (whichever is longer) together with a description of

of ownership), anyone hired to manage day-to-day

assumptions. Cash flow must be signed and dated.

operations of the business as well as any guarantors for

the loan. Business Plan required for a new business.

______ 9. A schedule of debts which includes the original date and

Appropriate documentation for mortgages taken as

amount, monthly payment, interest rate, present balance

collateral (i.e. copy of mortgage, deed, title, etc.). Fee

owed, maturity, to whom payable, and collateral securing

Disclosure and Compensation [SBA Form 159 (7A) (8-

the loan for each short-term and long term loan that the

14)], Packaging Notice and Fee.

business currently has outstanding or has planned for the

next twelve (12) months. Please indicate whether each

Amount of Packaging Fee: $__________

loan is current or delinquent. A Schedule of any personal

______ 2. Personal History Statement [SBA Form 912 (2-2013)]

or business government debts is also required.

current within ninety (90) days for each principal with

20% or more ownership of the SBC, any director or

______

10.The names of any affiliated (through ownership or

officer of the business (regardless of ownership) and

management control) or subsidiary businesses, as well as

anyone hired to manage day-to-day operations of the

the last three (3) fiscal year-end financial statements

business (required on both EPCs and OC). If non-U.S.

and/or federal income tax returns for the last three (3)

Citizen, an INS Form G-845 and accompanying

years. A current Balance Sheet and Profit & Loss of the

documentation (i.e. INS Consent Form, front/back legible

affiliate business dated within the last one-hundred eighty

copy of legal resident alien card) of anyone with 20% or

(180) days. Please be sure all tax returns/interims are

more ownership or anyone who controls the small

signed.

business applicant is required. Legible copy of driver’s

license or state issued ID for each principal of the

______ 11.If the business is a f ranchise, a copy of the Franchise

borrowing entity.

Agreement and the Franchiser’s Disclosure Statement

(required by the Federal Trade Commission), or a copy of

______ 3. Personal Financial Statement [SBA Form 413 (09-14)]

a Certificate of Franchise Documents executed by a

current within ninety (90) days for each proprietor, partner

franchise representative (only applies to franchises listed

or stockholder with 20% or more ownership of the

on SBA Franchise Registry).

EPCs/OCs, as well as any guarantors for the loan. A copy

of the federal personal income tax return for the last three

______ 12.Key cost documents (i.e. real estate purchase agreements,

(3) years is required. If an extension for the most recent

contractor cost estimates, vendor quotes for machinery

year was filed, please submit the previous year’s tax

and equipment, as well as an itemized list of professional

return, as well as the signed extension request form (if

fees). Copy of Note from Interim Lender for debt being

applicable). Please be sure that all tax returns are

refinanced with loan proceeds is required. For any credit

Credit Reports for the each principal and

card debt in the business’ name, a L ender/Borrower

signed.

guarantor current within 90 days.

Certification is to be signed stating the credit card debt

was used for business purposes only. If credit card debt is

______ 4. Resumés for each principal of the borrowing entity or

in a principal’s individual name and is being refinanced

individual involved in the day-to-day operations of the

with loan proceeds, Borrower must prove business related

business.

purchases with invoices and proofs of payment and sign a

Lender/Borrower Certification that the debt was for

______ 5. Three (3) years federal income tax returns for the SBC.

business purposes.

The tax returns must be signed. If the SBC is a new

business, provide a proforma balance sheet with a

______ 13.If Applicable, a co py of the existing or proposed Lease

description of assumptions attached.

Agreement.

______ 6. A current Balance Sheet and Profit & Loss of the existing

______ 14.Environmental Questionnaire, if applicable. Please be

business dated within the last one-hundred eighty (180)

sure this is signed by Purchaser and Seller (if applicable).

days of the application together with an aging of the

accounts receivable and accounts payable listed. Interims

______ 15.Organizational Documents of the Borrower.

must be signed and dated.

______ 16.Request for Copy of Tax Transcripts [IRS Form 4506-T

______ 7. Where applicable, a p rojected, annualized Income

(Rev. September 2015)] for existing businesses. I f

Statement for the first two (2) years after the loan with a

purchasing an existing business, please forward to the

description of assumptions attached. Projections must be

Seller for signature.

signed and dated.

_____ 17. Commitment Letter and Guaranty Deposit Fee

Amount of Deposit: $__________

V:JessicaChecklistsBDCChecklist Applicant 7a_10.21.15.docx

1

1