Form Au-677 - Declaration Of Payment Of Connecticut Sal Es And Use Tax On A Motor Vehicle Or Vessel - 2011

ADVERTISEMENT

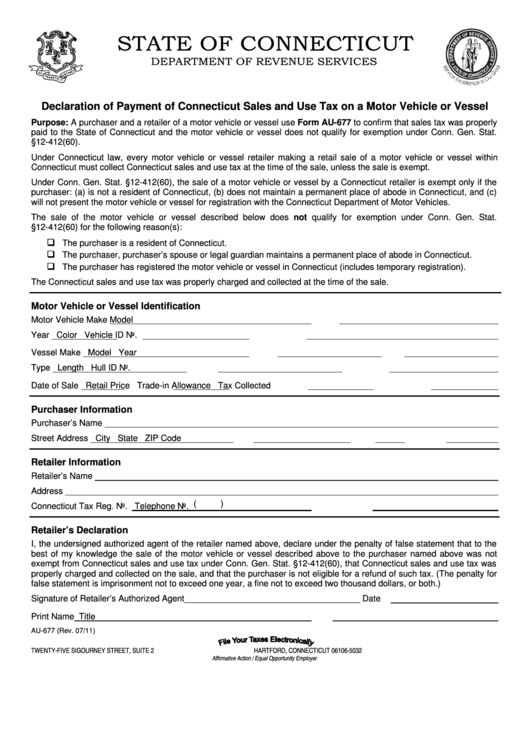

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

Declaration of Payment of Connecticut Sales and Use Tax on a Motor Vehicle or Vessel

Purpose: A purchaser and a retailer of a motor vehicle or vessel use Form AU-677 to confirm that sales tax was properly

paid to the State of Connecticut and the motor vehicle or vessel does not qualify for exemption under Conn. Gen. Stat.

§12-412(60).

Under Connecticut law, every motor vehicle or vessel retailer making a retail sale of a motor vehicle or vessel within

Connecticut must collect Connecticut sales and use tax at the time of the sale, unless the sale is exempt.

Under Conn. Gen. Stat. §12-412(60), the sale of a motor vehicle or vessel by a Connecticut retailer is exempt only if the

purchaser: (a) is not a resident of Connecticut, (b) does not maintain a permanent place of abode in Connecticut, and (c)

will not present the motor vehicle or vessel for registration with the Connecticut Department of Motor Vehicles.

The sale of the motor vehicle or vessel described below does not qualify for exemption under Conn. Gen. Stat.

§12-412(60) for the following reason(s):

The purchaser is a resident of Connecticut.

The purchaser, purchaser’s spouse or legal guardian maintains a permanent place of abode in Connecticut.

The purchaser has registered the motor vehicle or vessel in Connecticut (includes temporary registration).

The Connecticut sales and use tax was properly charged and collected at the time of the sale.

Motor Vehicle or Vessel Identification

Motor Vehicle Make

Model

Year

Color

Vehicle ID No.

Vessel Make

Model

Year

Type

Length

Hull ID No.

Date of Sale

Retail Price

Trade-in Allowance

Tax Collected

Purchaser Information

Purchaser’s Name

Street Address

City

State

ZIP Code

Retailer Information

Retailer’s Name

Address

Telephone No. (

)

Connecticut Tax Reg. No.

Retailer’s Declaration

I, the undersigned authorized agent of the retailer named above, declare under the penalty of false statement that to the

best of my knowledge the sale of the motor vehicle or vessel described above to the purchaser named above was not

exempt from Connecticut sales and use tax under Conn. Gen. Stat. §12-412(60), that Connecticut sales and use tax was

properly charged and collected on the sale, and that the purchaser is not eligible for a refund of such tax. (The penalty for

false statement is imprisonment not to exceed one year, a fine not to exceed two thousand dollars, or both.)

Signature of Retailer’s Authorized Agent _____________________________________ Date

Print Name

Title

AU-677 (Rev. 07/11)

TWENTY-FIVE SIGOURNEY STREET, SUITE 2

HARTFORD, CONNECTICUT 06106-5032

Affirmative Action / Equal Opportunity Employer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1