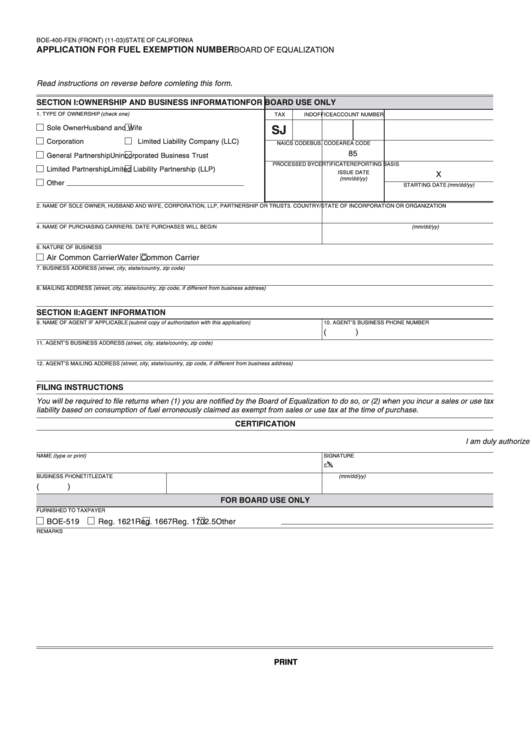

BOE-400-FEN (FRONT) (11-03)

STATE OF CALIFORNIA

APPLICATION FOR FUEL EXEMPTION NUMBER

BOARD OF EQUALIZATION

Read instructions on reverse before comleting this form.

SECTION I: OWNERSHIP AND BUSINESS INFORMATION

FOR BOARD USE ONLY

1. TYPE OF OWNERSHIP (check one)

TAX

IND

OFFICE

ACCOUNT NUMBER

Sole Owner

Husband and Wife

SJ

Corporation

Limited Liability Company (LLC)

NAICS CODE

BUS. CODE

AREA CODE

85

General Partnership

Unincorporated Business Trust

PROCESSED BY

CERTIFICATE

REPORTING BASIS

Limited Partnership

Limited Liability Partnership (LLP)

ISSUE DATE

X

(mm/dd/yy)

Other

STARTING DATE (mm/dd/yy)

2. NAME OF SOLE OWNER, HUSBAND AND WIFE, CORPORATION, LLP, PARTNERSHIP OR TRUST

3. COUNTRY/STATE OF INCORPORATION OR ORGANIZATION

4. NAME OF PURCHASING CARRIER

5. DATE PURCHASES WILL BEGIN (mm/dd/yy)

6. NATURE OF BUSINESS

Air Common Carrier

Water Common Carrier

7. BUSINESS ADDRESS (street, city, state/country, zip code)

8. MAILING ADDRESS (street, city, state/country, zip code, if different from business address)

SECTION II: AGENT INFORMATION

9. NAME OF AGENT IF APPLICABLE (submit copy of authorization with this application)

10. AGENT’S BUSINESS PHONE NUMBER

(

)

11. AGENT’S BUSINESS ADDRESS (street, city, state/country, zip code)

12. AGENT’S MAILING ADDRESS (street, city, state/country, zip code, if different from business address)

FILING INSTRUCTIONS

You will be required to file returns when (1) you are notified by the Board of Equalization to do so, or (2) when you incur a sales or use tax

liability based on consumption of fuel erroneously claimed as exempt from sales or use tax at the time of purchase.

CERTIFICATION

I am duly authorized to sign this application and certify the statements made are correct to the best of my knowledge and belief.

I am duly authorized to sign this application and certify the statements made are correct to the best of my knowledge and belief.

NAME (type or print)

SIGNATURE

✍

DATE (mm/dd/yy)

BUSINESS PHONE

TITLE

(

)

FOR BOARD USE ONLY

FURNISHED TO TAXPAYER

BOE-519

Reg. 1621

Reg. 1667

Reg. 1702.5 Other

REMARKS

CLEAR

PRINT

1

1