Form Swif-51 - Voluntary Election Of Coverage Form - Labor & Industry

ADVERTISEMENT

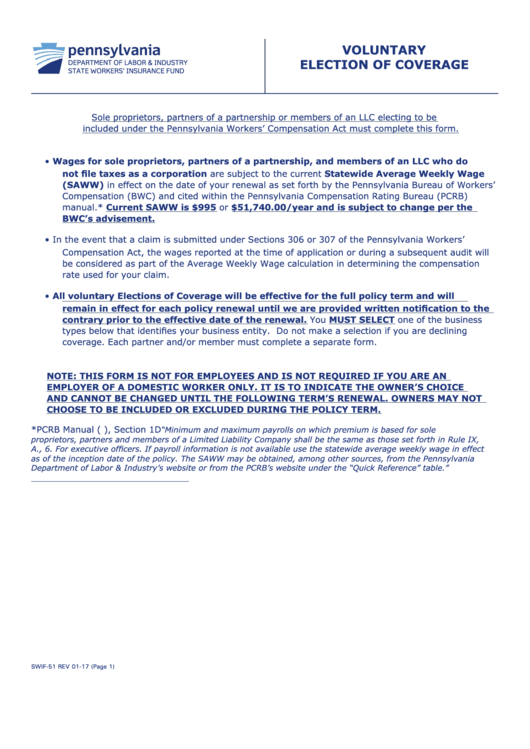

VOLUNTARY

DEPARTMENT OF LABOR & INDUSTRY

ELECTION OF COVERAGE

STATE WORKERS’ INSURANCE FUND

Sole proprietors, partners of a partnership or members of an LLC electing to be

included under the Pennsylvania Workers’ Compensation Act must complete this form.

• Wages for sole proprietors, partners of a partnership, and members of an LLC who do

not file taxes as a corporation are subject to the current Statewide Average Weekly Wage

(SAWW) in effect on the date of your renewal as set forth by the Pennsylvania Bureau of Workers’

Compensation (BWC) and cited within the Pennsylvania Compensation Rating Bureau (PCRB)

manual.* Current SAWW is $995 or $51,740.00/year and is subject to change per the

BWC’s advisement.

• In the event that a claim is submitted under Sections 306 or 307 of the Pennsylvania Workers’

Compensation Act, the wages reported at the time of application or during a subsequent audit will

be considered as part of the Average Weekly Wage calculation in determining the compensation

rate used for your claim.

• All voluntary Elections of Coverage will be effective for the full policy term and will

remain in effect for each policy renewal until we are provided written notification to the

contrary prior to the effective date of the renewal. You MUST SELECT one of the business

types below that identifies your business entity. Do not make a selection if you are declining

coverage. Each partner and/or member must complete a separate form.

NOTE: THIS FORM IS NOT FOR EMPLOYEES AND IS NOT REQUIRED IF YOU ARE AN

EMPLOYER OF A DOMESTIC WORKER ONLY. IT IS TO INDICATE THE OWNER’S CHOICE

AND CANNOT BE CHANGED UNTIL THE FOLLOWING TERM’S RENEWAL. OWNERS MAY NOT

CHOOSE TO BE INCLUDED OR EXCLUDED DURING THE POLICY TERM.

*PCRB Manual (), Section 1D

“Minimum and maximum payrolls on which premium is based for sole

proprietors, partners and members of a Limited Liability Company shall be the same as those set forth in Rule IX,

A., 6. For executive officers. If payroll information is not available use the statewide average weekly wage in effect

as of the inception date of the policy. The SAWW may be obtained, among other sources, from the Pennsylvania

Department of Labor & Industry’s website or from the PCRB’s website under the “Quick Reference” table.”

SWIF-51 REV 01-17 (Page 1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2