Form N-314-Hotel Construction And Remodeling Tax Credit Page 2

ADVERTISEMENT

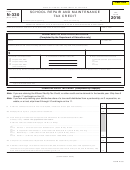

FORM N-314

(REV. 2001)

of the renovation cost for which a deduction is taken under IRC

In the case of a partnership, S corporation, estate, trust,

section 179. Do not include costs for routine maintenance or repairs.

association of apartment owners of a qualified hotel facility, time

share owners association, or any developer of a time share project,

Line 2 — Flow through of qualifying construction or renovation

the tax credit allowable is for qualified construction or renovation

costs received from other entities, if any. In the case of a taxpayer

costs incurred by the entity for the taxable year. The construction or

who is a member of a pass-through entity (i.e., partnership, S

renovation costs upon which the tax credit is computed is determined

corporation, estate, or trust) and who claims a tax credit for the

at the entity level. Each partner, S corporation shareholder, or

entity’s qualified construction or renovation costs, enter the amount

beneficiary of an estate or trust shall separately take into account for

of the costs received from the entity on line 2.

its taxable year with or within which the entity’s taxable year ends,

Line 3 — Estates and trusts: The total cost on line 3 is to be

the partner’s, shareholder’s, or beneficiary’s share of the construction

allocated between the estate or trust and the beneficiaries in the

or renovation costs and resulting tax credit. A partner’s share of the

proportion of the income allocable to each party. On the dotted line

construction or renovation costs shall be determined in accordance

to the left of line 3, enter the cost allocable to the estate or trust with

with the ratio in which the partners divide the general profits of the

the designation “N-40 PORTION”. Attach Form N-314 to the N-40

partnership. The construction or renovation costs of the partnership

return and show the distributive share of the costs for each

which are subject to a special allocation that is recognized under IRC

beneficiary.

section 704(a) and (b) shall be recognized for the purposes of this

Line 5 — Enter the total tax credit claimed for the year on this line

tax credit. Each S corporation shareholder’s construction or

and on Schedule CR, Line 13 or enter the estate’s or trust’s share on

renovation costs is the shareholder’s allocated share of the S

Form N-40, Schedule F, line 3. For individual taxpayers, round the

corporation’s construction or renovation costs. A beneficiary’s share

amount on line 5 to the nearest dollar.

of the construction or renovation costs is apportioned between the

Part II

entity and the beneficiaries based on the income of the entity

allocable to each. The term “beneficiary” includes an heir, legatee,

Part II is for associations of apartment owners and timeshare

or devisee. Associations of apartment owners and timeshare owners

owners associations to provide information to the associations’

associations, see the instructions for Part II.

owner-members regarding the members’ share of the associations’

qualifying construction or renovation costs.

Each member must

Tax credit to be deducted from income tax liability, if any;

qualify for the credit on its own. The fact that this information is

refunds. If the tax credit exceeds the taxpayer’s income tax liability,

provided to a member, does not qualify that member to take the

the excess of tax credit over liability shall be refunded to the

credit.

taxpayer; provided that no refunds or payment on account of the tax

credit shall be made for amounts less than $1. There shall be no

Any association of apartment owners or timeshare owners

carryback or carryover of excess tax credit over tax liability.

association which has incurred qualifying construction or renovation

costs for a qualified hotel facility located in Hawaii shall provide to its

Time for filing. All claims for the tax credit must be filed on or

members a statement of the member's share of those qualifying

before the end of the 12th month following the close of the taxable

costs on this form.

year for which the tax credit may be claimed. An extension of time for

filing a return does not extend the time for claiming the tax credit.

Name of association — The association’s name is to appear in

Failure to comply with the foregoing provision shall constitute a

the name space near the top of the form.

waiver of the right to claim the tax credit.

Line 1. — Member’s name - Enter the member's name on this

Definitions. For purposes of the tax credit:

line.

“Qualified hotel facility” means a hotel/hotel-condo as defined in

Line 2. — Member’s identification number - Enter the member’s

section 486K-1, HRS, and includes a time share facility or project.

social security number or federal employer identification number.

“Construction or renovation cost” means any cost incurred after

Line 3. — Member’s share of qualifying costs - Enter the

December 31, 1998, for plans, design, construction, and equipment

member’s

share

of

the

total

qualifying

construction

or

related to new construction, alterations, or modifications to a qualified

renovationcosts incurred by the association.

hotel facility.

Instructions for Members

SPECIFIC INSTRUCTIONS

If you have received this form from your association, you may, or

may not, qualify for the credit. See the General Instructions of this

Part I

form to determine if you qualify to take this credit. If you qualify to

Line 1 — Enter the qualifying construction or renovation costs

take the credit, enter the amount in Part II, line 2 of the Form N-314

incurred during the taxable year for qualified hotel facility(ies) located

you received from your association of apartment owners or

in Hawaii. Do not include that portion of the construction or

timeshare owners on line 2 of Part I and check box d of the Form

renovation costs for which another tax credit was claimed under

N-314 you will use to compute your credit and file with your return.

chapter 235, HRS, for the taxable year. Do not include that portion

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2