NJ-1065

Page 2

Partnership name as shown on Form NJ-1065

Federal EIN

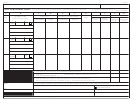

PARTNERS DIRECTORY

.

List all partners, including principal address. Add additional sheets as necessary.

____________

1. Corporation Allocation Factor

A

B

G

H

C

D

E

F

I

J

K

Distributive Share of Partnership

Net Gain (Loss) From Disposition of Assets

Nonresident Partner’s

Nonresident

Income (Loss)

SS Number or FEIN

as a result of a Complete Liquidation

Code

Pension

Noncorporate

Corporate

Share of

Share of Total

Name and Principal Address

Total Distribution

NJ Source

Total Gain (Loss)

NJ Source

Partner’s Share

Partner’s Share

Income

NJ Income

of Tax

of Tax

% owned

Final

by Partner

% owned

Final

by Partner

% owned

Final

by Partner

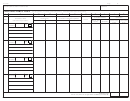

2a. Total This Page. Enter zero, if no tax is reported in Column(s) J and/or K.

2b. Total From ___________________________ Additional Pages

Attached. Enter zero,

if no tax is

reported in Column(s) J and/or K.

2c. Total Tax (add Lines 2a and 2b). Enter the totals here and carry the total in Column J to

Line 24, Column B, and the total in Column K to Line 25, Column B on front of Form NJ-1065.

Signature of General Partner or Limited Liability Company

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct and complete. Declaration of preparer (other than general partner) is based on all information of which preparer has any knowledge.

Member.

Paid Preparer’s Signature

Date

Check if Self-Employed

Date

Firm’s Name (or yours if self-employed)

Preparer’s SS # or PTIN

Preparer’s Address

Preparer’s Federal EIN #

A complete Federal

Form 1065 including all schedules and supporting attachments may be required during the course of an audit.

1

1 2

2 3

3 4

4